14 Great Ways to Spend or Invest $1,000

If you have a stash of cash earning practically nothing, take a gander at the 14 ideas we present in this slide show.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you have a stash of cash earning practically nothing, take a gander at the 14 ideas we present in this slide show. We put our entire staff to work brainstorming and researching suggestions to unlock the power of your money. These ideas require only a small stack of bills, and all of them are either timely or practical or worthy of a splurge. Take a look.

Get Instant Diversification

For $1,000, you can own a little bit of everything with Vanguard Star Fund (symbol VGSTX), a collection of 11 actively managed, low-expense Vanguard funds. Star has roughly 60% of its assets in stocks and the rest in bonds. Within the eight stock funds, you’ll find large- and small-company U.S. stocks; fast-growing companies and slower growers that trade at bargain prices; and nearly 20% in foreign stocks. Star also holds funds that invest in short-term, medium-term and long-term bonds. Star beat similar funds in nine of the past 10 calendar years.

Buy Inflation Protection

To hedge against rising rates and prices, invest in Treasury inflation-protected securities. TIPS, which are issued by Uncle Sam, pay a fixed rate of interest on a principal that is adjusted for inflation. When your bond matures, you receive the inflation-adjusted principal. You can buy TIPS, which are sold in $100 increments in maturities of five, 10 and 30 years, directly at TreasuryDirect.gov.

Fly Like a Celeb (for an Hour or Two)

A first-class suite on an international flight could cost more than your child’s first year of college. But assuming you plan to travel from New Zealand to Australia anyway, you can get a dollop of luxury for less than $1,000 if you hop aboard the Auckland to Sydney, Melbourne or Brisbane leg of a longer Emirates airlines route to Australia. You can loll in a private compartment, drink at the onboard lounge and even take a mid-flight shower (hair dryer included).

Caribbean Beach Weekend

You can scoop up great deals to the Caribbean for a long weekend getaway this winter. We recently found a package to Riu Montego Bay in Jamaica on CheapCaribbean.com for $679 per person (four nights, airfare included), with travel through June. You can relax by the expansive pool with the “drink of the day” and eat jerk chicken from a local shack, or head to nearby Dunn’s River Falls for zip-lining, hiking and snorkeling.

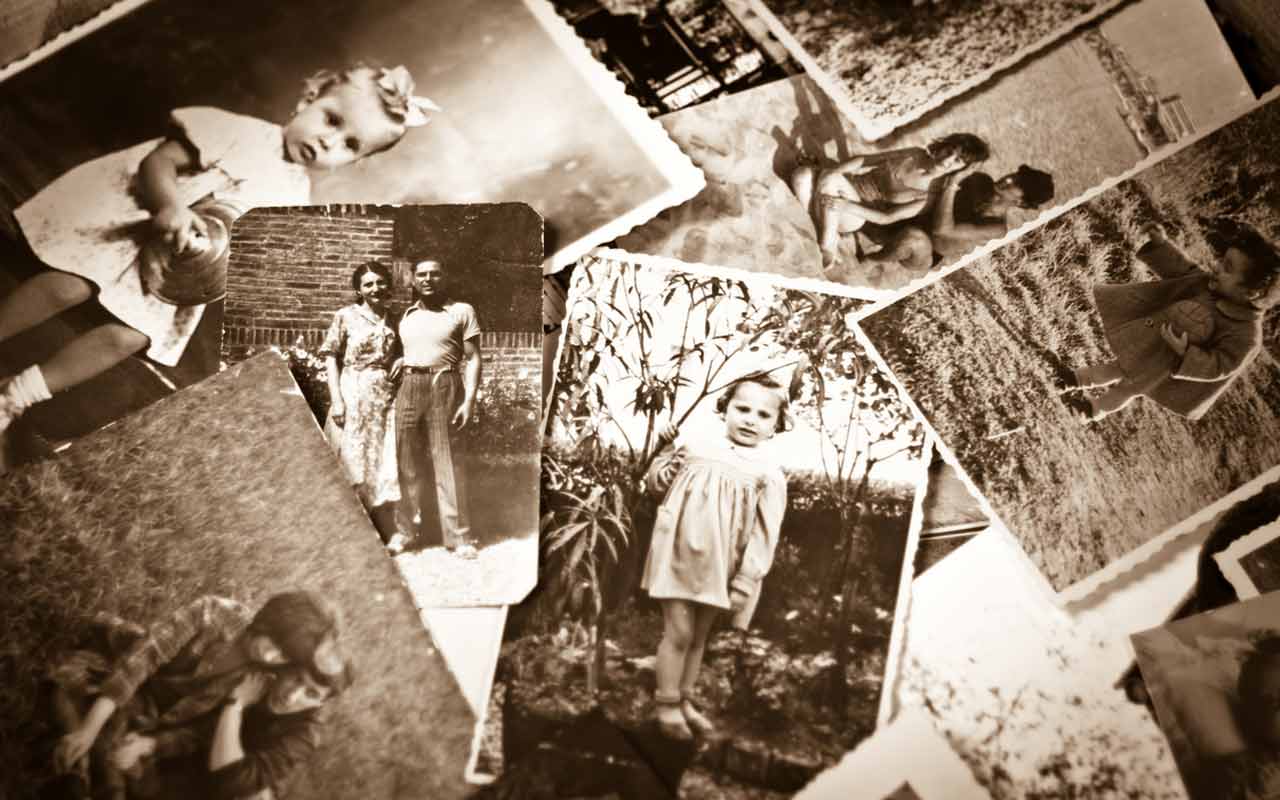

Learn Your Family History

Tracing your ancestry can be an overwhelming task, but with $1,000 you can get a lot of handholding. Start with a few introductory sessions through Legacy Family Tree Webinars ($45 a year) and download a course pack at Vigrgenealogy.com ($70 each) for deeper dives into, say, wartime records or Irish ancestry. Join a genealogical website such as Ancestry.com ($199 for six months of full access) to search massive stores of documents and connect with far-flung relatives. A professional researcher can analyze your work and guide you through the next steps, at $40 to $75 per hour, says Catherine Desmarais, owner of Stone House Historical Research. (Plan on spending $300 to $600.) Use the leftover funds to take a DNA test at Ancestry.com ($99), which has the largest database of testers, to discover your ethnic makeup.

Hire a Virtual Alfred

Having an assistant who handles menial tasks isn’t just for the Bruce Waynes of the world anymore. Subscribers to FancyHands get a team of U.S.-based online “virtual assistants” who are available 24/7 to complete ad-hoc tasks that take 20 minutes or less. Common tasks include sending e-mails, scheduling appointments, making phone calls and doing quick research projects. Or give your assistants your shopping list; they can make purchases of up to $200 on your behalf. A yearlong subscription costs $800 and gets you 15 tasks per month. Whether you use the extra time to fight crime is entirely up to you.

Contribute to a Health Savings Account

If you have an eligible health insurance policy, you can invest the HSA money (see HSASearch.com) and let it grow tax-free for future eligible expenses (save your statements so you can claim the expense later). You can’t make new HSA contributions after you enroll in Medicare, but you can use the money you’ve already saved tax-free for Medicare premiums plus out-of-pocket medical and drug costs.

Support a Local Charity

Although $1,000 is a drop in the bucket for major charities, it could make a huge difference to your local arts council, food bank or animal shelter. Most small charities aren’t rated by watchdog groups such as Charity Navigator and CharityWatch, so check out the charity’s website to see the financial information it provides potential donors, says Sandra Miniutti, a spokeswoman for Charity Navigator. Ask the group for a copy of its Form 990, the annual report charities are required to provide to the IRS. You can find the report online free at Guidestar.org, but requesting a copy from the charity “is a good litmus test of how transparent they’re willing to be,” says Miniutti. Ask the organization for biographies of board members and top executives, says Daniel Borochoff, founder of CharityWatch.

Help Your Grandkids: Contribute to a Roth

If your grandchildren earn money, you can reward their hard work and seed their retirement by contributing to their Roth IRA or opening one for them. The contributions to each account may not exceed the amount they earned for the year, up to a maximum of $5,500 in 2017. They can withdraw the contributions tax- and penalty-free at any time, and after age 59½, they can withdraw both the contributions and the earnings tax- and penalty-free.

Splurge on a Tasting Experience

Drop $1,000 (for two) on one meal? We’re talking about Michelin-starred restaurants, the crème de la crème of eateries. At the three-star Per Se in New York City, the nine-course tasting menu carries a fixed price of $325. Guests could recently sample slow-cooked Atlantic monkfish, poularde (a fattened young hen) and other succulent dishes. With leftover funds, a couple can splurge on a bottle of wine. At the revamped three-star Alinea in Chicago, the “Gallery” menu and participatory experience costs $295 to $345 a head. Along with 14 other guests, you nibble on 16 to 18 creative courses.

Get a Lighter Laptop

The Dell XPS 13 is a worthy competitor to the latest version of Apple’s MacBook Pro. It weighs 2.9 pounds with a touch screen or 2.7 pounds without, and it squeezes a 13.3-inch display into a frame akin to those of 11-inch laptops. For $1,000, buy one with a seventh-generation Intel Core i5 processor, 8 gigabytes of memory and a 128GB solid-state hard drive. (For $1,300 you can upgrade to a higher-resolution, touch-enabled screen.)

Be a Locavore

Treat your family to locally grown produce or meat by buying shares in a farm, known as community supported agriculture (CSA) subscriptions. You can get a full-share or half-share size that you typically pick up weekly or biweekly. Prices vary, so $1,000 can go a little or a long way. For example, Delvin Farms, in College Grove, Tenn., charges $990 for its meat-share in the Nashville area. You get six deliveries of at least 20 pounds of beef, poultry, lamb and pork. Sage Mountain Farm, in Anza, Calif., offers a large, seasonal-produce CSA for a little more than $800 for 26 deliveries to San Diego and Temecula, Calif. Visit LocalHarvest.org to locate CSA subscriptions in your area.

Buy a New Mattress

For less than a grand you can replace your old mattress with one that’s likely to be more comfortable and supportive and give you a better night’s sleep. The Casper mattress (queen, $850), which gets top marks from reviewers, combines memory foam (for support and contouring of the body) with latex foam (for breathability and bounce). Like other manufacturers of “mattresses in a box,” Casper sells and ships directly to you, eliminating the middleman’s mark-up and annoying sales tactics. The company provides free shipping and a 100-night trial—plus free pickup and a full refund if you don’t like it. In lieu of a traditional box spring, Casper strongly recommends buying a separate foundation ($250) for proper support of the mattress. Check the website for special offers (mattresses were recently $75 off).

Refresh a Bathroom

Hire a handyman to paint walls, ceiling and trim ($285 to $400 for a 40-square-foot room, according to Homewyse.com) and replace an outdated sink faucet set ($200 to $300) and vanity light fixture ($74 to $170). If you’re paying at the low end of those ranges, you can replace the tub or shower faucet, too ($287), with your $1,000 budget.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

12 Great Places to Retire in the Midwest

12 Great Places to Retire in the MidwestPlaces to live Here are our retirement picks in the 12 midwestern states.

-

15 Cheapest Small Towns to Live In

15 Cheapest Small Towns to Live InThe cheapest small towns might not be for everyone, but their charms can make them the best places to live for plenty of folks.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Six Best Places to Retire in New England

The Six Best Places to Retire in New Englandplaces to live Thinking about a move to New England for retirement? Here are the best places to land for quality of life, affordability and other criteria.