10 States With the Highest Beer Taxes

Find out where you'll spend the most money on some suds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There's nothing like cracking open a cold one at the end of a hot summer’s day. But the dollars and cents you’re drinking away without even realizing it can leave a bitter aftertaste. In addition to paying the federal tax of up to $0.58 per gallon,* consumers face state taxes for beer — typically paid by brewers and distributors before the beer reaches store shelves, but nonetheless impacting the final cost of a cold brew. In fact, 40% of the retail price of beer comes from taxes — the most expensive ingredient, according to the Beer Institute.

Check out our list of the 10 states with the highest beer tax. That way you can budget accordingly the next time you’re visiting one of these areas and planning to bar hop.

*Federal beer taxes are lower for smaller breweries.

Mississippi

- Beer: $0.43 per gallon

- Wine: $0.35 per gallon

- Liquor: $2.50 per gallon

- Go to Mississippi's Full State Profile

There are “wet” and “dry” counties in Mississippi, which means there are some jurisdictions where it’s illegal to sell alcohol of any kind. In those that do allow it, residents can purchase beer and light wine at convenience and grocery stores, but not liquor. Those are available at off-premise sites, such as liquor stores. If you’re in a county where beer can be sold, just know that you’ll have to plunk down an extra 43¢ per gallon for a cold one.

Lazy Magnolia, which was established in Kiln in 2005, became Mississippi’s first packaging brewery since prohibition. Their roster of ales -- from “Southern Pecan” to “Grapefruit Radler” -- can also be purchased in Arkansas, Colorado and West Virginia, among several other states.

Idaho

- Beer: $0.45 per gallon (beer exceeding 4% alcohol by weight)

- Wine: $0.45 per gallon

- Liquor: $10.91 per gallon

- Go to Idaho's Full State Profile

In Idaho, beer with alcohol by weight exceeding 4% is categorized as a strong beer and taxed as wine. That explains why the rate for both beer and wine in the Gem State is priced at 45¢ per gallon. Beer containing less than 4% of alcohol by weight is taxed at a rate of 15¢ per gallon.

One of the more unique brewery concepts comes from Boise Brewing, which opened in 2014 in the state’s capital city of Boise. It’s a community-owned brewery. So, in addition to having an initial round of traditional investors, everyday customers who were willing to make a minimum investment contribution became part-owners in the company, as well.

Florida

- Beer: $0.48 per gallon

- Wine: $2.25 per gallon

- Liquor: $6.50 per gallon

- Go to Florida's Full State Profile

Pouring up in the Sunshine State will cost you — no matter if you’re drinking a mug of beer, a glass of wine or sipping on a cocktail. At 48¢ per gallon, the beer tax rate is costly; especially when you consider that in Wyoming — which has the lowest rate — it’s just 2¢ per gallon. The wine and liquor rates in Florida are even steeper. Still wine, which isn’t effervescent, is set at $2.25. However, the cost per gallon for a sparkling version bumps up to $3.50. And spirits with an alcohol content above 56% — some barrel-proof whiskeys, for example — are $9.53 per gallon.

There are more than 300 breweries located in Florida -- from mom and pop businesses to warehouse set-ups, according to FloridaRambler.com. Among them is Bowigens Beer Company, which was started by two friends in their garage in 2014. Since then, the brewery’s “7 Layer Milk Stout” beer has racked up multiple awards including the 2019 Best of Craft Beer Award.

North Carolina

- Beer: $0.62 per gallon

- Wine: $1.00 per gallon

- Liquor: $14.58 per gallon

- Go to North Carolina's Full State Profile

You’d think North Carolina would be on the lax side when it comes to taxing beer. After all, they’re soft on other “sin taxes” — the excise tax for cigarettes is only $0.45 per pack, one of the lowest in the U.S. If you still crave a brew despite the high tax (62¢ per gallon), there are plenty of good options. Asheville, N.C., is home to the second-most breweries per capita of any city in the country. And it wouldn't be fair to mention what's been dubbed "Beer City USA" without naming the godfather of its scene, Oscar Wong, who opened Highland Brewing Company in a basement back in 1994.

South Carolina

- Beer: $0.77 per gallon

- Wine: $0.90 per gallon

- Liquor: $2.72 per gallon

- Go to South Carolina's Full State Profile

South Carolina doesn’t make it easy on brewers. Its 77¢ per gallon tax rate on beer is among the highest in the country. But other alcohol doesn’t get as bad a deal — the state’s wine tax and spirit tax fall roughly in the middle of the pack in the U.S.

But if you’re still game for a cold one, South Carolina has a few big dogs to look out for. The Palmetto Brewing Company revived brewing in South Carolina (dead since Prohibition) in 1993. The brewery offers a rotating selection of small batch and experimental brews on tap. Among the state’s smaller breweries is the family-owned COAST Brewing Co., which uses all locally sourced ingredients to produce their brews.

Hawaii

- Beer: $0.93 per gallon

- Wine: $1.38 per gallon

- Liquor: $5.98 per gallon

- Go to Hawaii's Full State Profile

You’re going to pay top dollar to drink up in the Aloha State. Hawaii’s beer tax is pretty steep at 93¢ per gallon. It’s per gallon tax rate on wine is nearly $1.50, but jumps to $2.12 if it’s a sparkling variety (think: Prosecco or Moscato).

When it comes to beer in Hawaii, the big name brand you’ve likely heard of is Kona Brewing Co. It’s been around for over 25 years. But the “liquid aloha” drink was bought by Craft Brew Alliance in 2010, so much of its production is now in Portland, Ore., Portsmouth N.H., and Fort Collins, Colo. If you’re in Maui (or visiting), check out the Kohola Brewery in the heart of Lahaina. Founded by homebrewers, Kohola adds pineapple, lilikoi or coconut to give its beers a Hawaiian touch.

Georgia

- Beer: $1.01 per gallon

- Wine: $1.51 per gallon

- Liquor: $3.79 per gallon

- Go to Georgia's Full State Profile

At $1.01 per gallon (includes mandatory 53¢ per gallon local tax), it’s no surprise that the Peach State is among our top five states with the highest beer tax in the country. As for other types of alcohol, Georgia enforces an excise tax on a variety of wines (table, dessert and fortified), as well as distilled spirits and malt beverages.

The state’s oldest craft brewery, Atlanta Brewing Company, was founded in 1993. The brewery’s flagship “Red Brick” ale became so popular that 4,000 barrels were produced in its first year of production. Atlanta Brewing Company now has 28 beer varieties on tap including Hoplanta IPA and Soul of the City pale ale.

Alabama

- Beer: $1.05 per gallon

- Wine: $1.96 per gallon

- Liquor: $19.11 per gallon

- Go to Alabama's Full State Profile

At $1.05 per gallon (includes mandatory 52¢ per gallon local tax), Alabama’s beer tax isn’t exactly a bargain, but it’s on the lighter side compared to other alcohol sales in the state. The tax on spirits is the highest among the states on this list, and the tax on wine is the third-highest. So if you’re bar-hopping and looking for a cheap drink, you might just want to turn to the tap.

Good People Brewing Company is the state’s oldest and largest brewery. It was established in Birmingham in 2008. In addition to Alabama, the brewery’s beers can be purchased in several states throughout the Southeast region, including Georgia, Tennessee and Florida.

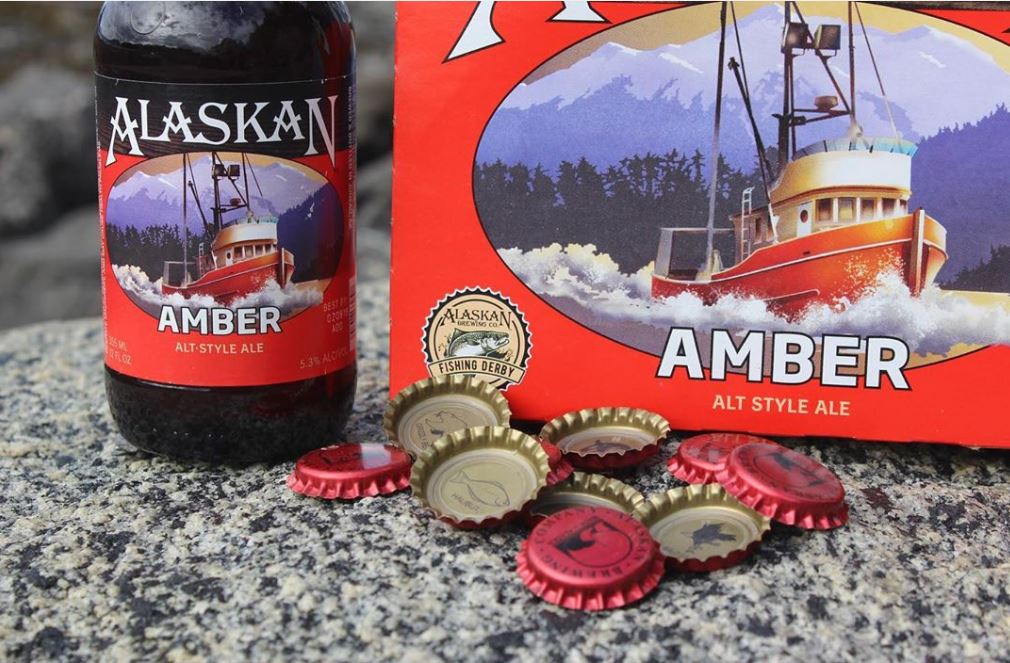

Alaska

- Beer: $1.07 per gallon

- Wine: $2.50 per gallon

- Liquor: $12.80 per gallon

- Go to Alaska's Full State Profile

Plenty of things are more expensive in Alaska, and beer is among them – due in part to being heavily taxed. The state’s excise tax on beer stands at $1.07 per gallon, which is the second highest rate in the country. So, if you’re looking for something to make you feel warm during a cold Alaskan night, beer might not be the most economical choice. Alaskan Brewing Company was the first post-Prohibition brewery to open in Juneau in 1986. While co-founder Marcy Larson was researching brewing before opening up shop, she discovered a beer recipe dating back to the state’s Klondike Gold Rush era. That almost century-old recipe became the brewery’s heralded Alaskan Amber.

Tennessee

- Beer: $1.29 per gallon

- Wine: $1.21 per gallon

- Liquor: $4.40 per gallon

- Go to Tennessee's Full State Profile

Tennessee has the highest tax rate for beer in the country, a whopping $1.29 per gallon. There's also an additional $0.15 tax on each case of alcoholic beverages sold in the state. Maybe stick to whiskey?

The Volunteer State continues to feel the legacy of prohibition, with some counties still opting to be dry (such as the one where Jack Daniels is distilled). Statewide, though, liquor laws affecting beer have been loosened over the years, leading to a strong uptick in the number of breweries.

Nashville is a hotspot for Tennessee’s craft brewery scene. Among the local breweries is Bearded Iris Brewing. Its founders named it after the state's flower. The brewery boasts a seemingly-endless array of variations on the traditional IPA.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Medler is a senior at Stanford University, majoring in Political Science and Communications. An intern finding her way in the professional world, she has quite the hodgepodge of communications experience — from reporting at the St. Louis Business Journal and The Riverfront Times, to working in politics, advertising, and even comedy at the television show Full Frontal with Samantha Bee. She also writes and edits for various campus publications including The Stanford Daily and Stanford Politics. Medler became a Kiplinger intern through the American Society of Magazine Editors Internship Program.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?

-

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?Quiz How well do you know the new 2026 IRS rules for wealth transfer and the specific tax brackets that affect your heirs? Let's find out!

-

5 Types of Gifts the IRS Won’t Tax: Even If They’re Big

5 Types of Gifts the IRS Won’t Tax: Even If They’re BigGift Tax Several categories of gifts don’t count toward annual gift tax limits. Here's what you need to know.