How to Get a Stimulus Check if You Don't File a Tax Return

Economic stimulus payments are generally based on information from 2018 or 2019 tax returns, but non-filers can still get a check. Here's how.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're eligible for a stimulus check (not everyone will get one), the IRS will grab the information it needs to process your payment from your 2018 or 2019 tax return. But what if you didn't file a tax return for those two years? After all, not everyone is required to file a return. Are you going to get a check, or is Uncle Sam going to stiff you?

The good news is that you'll still get a stimulus check—but you might have to send the IRS some information first. Whether that extra step is required, and how you provide the necessary information, depends on your unique situation. If, for instance, you're currently receiving Social Security or other government benefits, you might not have to do anything to receive a check. Other non-filers can choose between different methods of supplying the required information. Read on to find out how traditional non-filers can make sure they receive a stimulus check.

(Use our Stimulus Check Calculator to see how much money you'll get. For stimulus check FAQs, see Your 2020 Stimulus Check: How Much? When? And Other Questions Answered.)

Seniors, Veterans and Others Receiving Government Benefits

If you did not file a 2018 or 2019 tax return, you will still get a $1,200 check if you receive:

- Social Security retirement, disability, or survivor benefits;

- Railroad Retirement benefits;

- Supplemental Security Income (SSI); or

- Veteran pension, disability, or survivor benefits.

These payments will be sent automatically—you don't have to do anything. The IRS will get the information it needs from the Social Security Administration, Railroad Retirement Board, or Veterans Administration if it doesn't already have a 2018 or 2019 tax return with your name on it.

However, non-filing benefit recipients with dependents 16 years old or younger will have to go online and use the IRS's "Non-Filers: Enter Your Payment Info Here" tool to get an extra $500 per child added to their $1,200 payment. This should be done ASAP (by noon on April 22 for Social Security and Railroad Retirement beneficiaries). If you don't do this before the IRS processes your payment, you will have to wait until next year to claim the additional $500 per child as a credit on your 2020 tax return.

Your automatic stimulus payment will generally arrive in the same manner that you get your current benefits. In other words, if benefits are directly deposited into your bank account, then the stimulus payment will be electronically paid, too. If you receive your benefits by paper check, then you'll also receive a stimulus check in the mail.

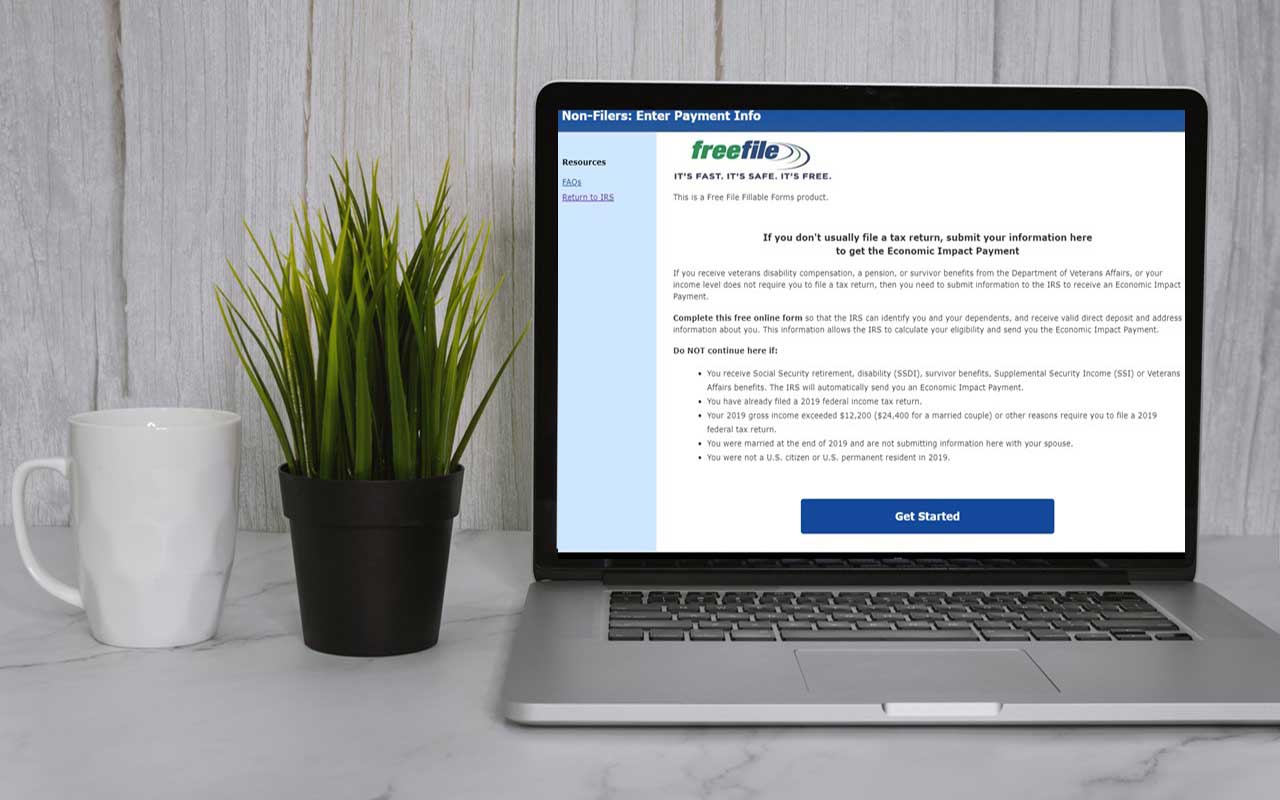

Using the IRS's Online Tool

If you're not receiving any of the government benefits listed above, you can use the "Non-Filers: Enter Your Payment Info Here" tool to provide the IRS with the information it needs to send you a stimulus check. If you want your payment directly deposited into your bank account, which is faster than getting a paper check, you can also provide your account information through the tool.

The IRS tool is intended for Americans who aren't required to file a federal income tax return for 2019, such as people with income under the tax return filing threshold (generally single people who made less than $12,200 and married couples who made less than $24,400 in 2019). If you filed a 2018 or 2019 return, you should not use the tool.

If you use the IRS tool, you'll be asked to provide your:

- Full name, current mailing address, phone number and email address;

- Date of birth;

- Marital status;

- Social Security number (and spouse's number, if applicable);

- Bank account number, type and routing number if you want payment by direct deposit;

- Identity Protection Personal Identification Number (IP PIN), if you have one; and

- Driver's license or state-issued ID number, if you have one.

To get an extra $500 for a qualifying child who is 16 years old or younger, you will also need to provide his or her name, Social Security number or Adoption Taxpayer Identification Number, and his or her relationship to you or your spouse. (You'll get $500 for each qualifying child.)

"Simplified" Tax Returns for Most Non-Filers

The IRS hopes most non-filers will go online and use the "Enter Your Payment Info Here" tool, but it also announced alternative procedures for filing "simplified" tax returns. If you file one of these simple returns by October 15, 2020, you will receive a stimulus check before the end of the year.

The first type of simplified return is for anyone who isn't required to file a 2019 return, but who wants to file just to get a stimulus payment (the second type is described below). This type of return can be filed electronically or by mailing in a paper return. However, the IRS spelled out very precise instructions on how the return should look. In addition to including your name, address, Social Security number, filing status, dependency status, and other basic information required on Form 1040 or Form 1040-SR, you must:

- Write "EIP2020" on the form (for paper returns, write it above the printed material at the top of page 1; for electronic returns, it must be included in the designated field);

- Leave Column 4 in the dependent information section blank (complete the rest of the section for each dependent who was under the age of 17 at the end of 2019);

- Enter $1 on Lines 2b (taxable interest), 7b (total income), and 8b (adjusted gross income);

- Enter the applicable standard deduction amount for your filing status on Line 9 if you're filing electronically;

- Enter $0 on Line 11b (taxable income);

- Leave the box on Line 21a unchecked, because stimulus payments can't be divided among multiple accounts;

- Leave all other lines blank, even if the values for these lines are in fact not zero; and

- Provide your identity protection personal identification number (IP PIN), if applicable, and sign the return under penalties of perjury.

In addition, you can request the direct deposit of your stimulus payment into your bank account by entering their required information on Lines 21b through 21d. You can also enter a paid preparer's information, if applicable, at the bottom of page 2.

"Simplified" Tax Returns for Non-Filers with $0 AGI

Some Americans who are not required to file a federal income tax return still do so to qualify for state or local government benefits. These people often have no income, but they need a federal return that is more detailed than the simplified return described above. However, people with an adjusted gross income (AGI) of zero are not able to file electronic returns due to tax software and return processing parameters. The second type of simplified return addresses this problem. It's only for electronically filed returns, though.

For this type of simplified return, a zero AGI filer must enter $1 for Lines 2b (taxable interest), 7b (total income), and 8b (adjusted gross income). For all other lines, follow the form instructions for Form 1040 or Form 1040-SR. You must also provide your IP PIN, if you have one, and sign the return under penalties of perjury. You can also add the paid preparer information if applicable at the bottom of page 2.

If the form is e-filed before October 15, 2020, you'll get your stimulus payment (either by direct deposit or paper check) by December 31, 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.