7 CARES Act Tax Breaks for Businesses

No matter what business you're in, there's probably at least one CARES Act tax breaks that can improve your bottom line and help you stay afloat.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While stimulus checks, small business loans and expanded unemployment benefits have gotten the lion's share of media coverage, there are also a number of important business tax breaks in the Coronavirus Aid, Relief, and Economic Security (CARES) Act that haven't received a lot of attention. Most of the new tax breaks are only temporary. Several of them tweak or reverse changes made by the 2017 tax reform law. All are designed to get coronavirus-ravaged businesses and workers back on their feet as quickly as possible. No matter what business you're in, at least one of these seven tax breaks is likely to improve your bottom line and help you stay afloat.

(For information on new business tax credits for providing paid sick and family leave benefits, which were enacted as part of the Families First Coronavirus Response Act, see Tax Credits Included in Coronavirus Paid Leave Law.)

Charitable Gift Deduction Expanded

Normally, a corporation can't deduct charitable contributions that exceed 10% of its taxable income for the year. Any amount over the 10% limit can be carried over for up to five years. Under the CARES Act, the taxable income limit on 2020 charitable gifts of cash rises to 25%.

The CARES Act also increases the limitation on deductions for 2020 contributions of food inventory from 15% to 25%.

Payroll Tax Payment Delayed

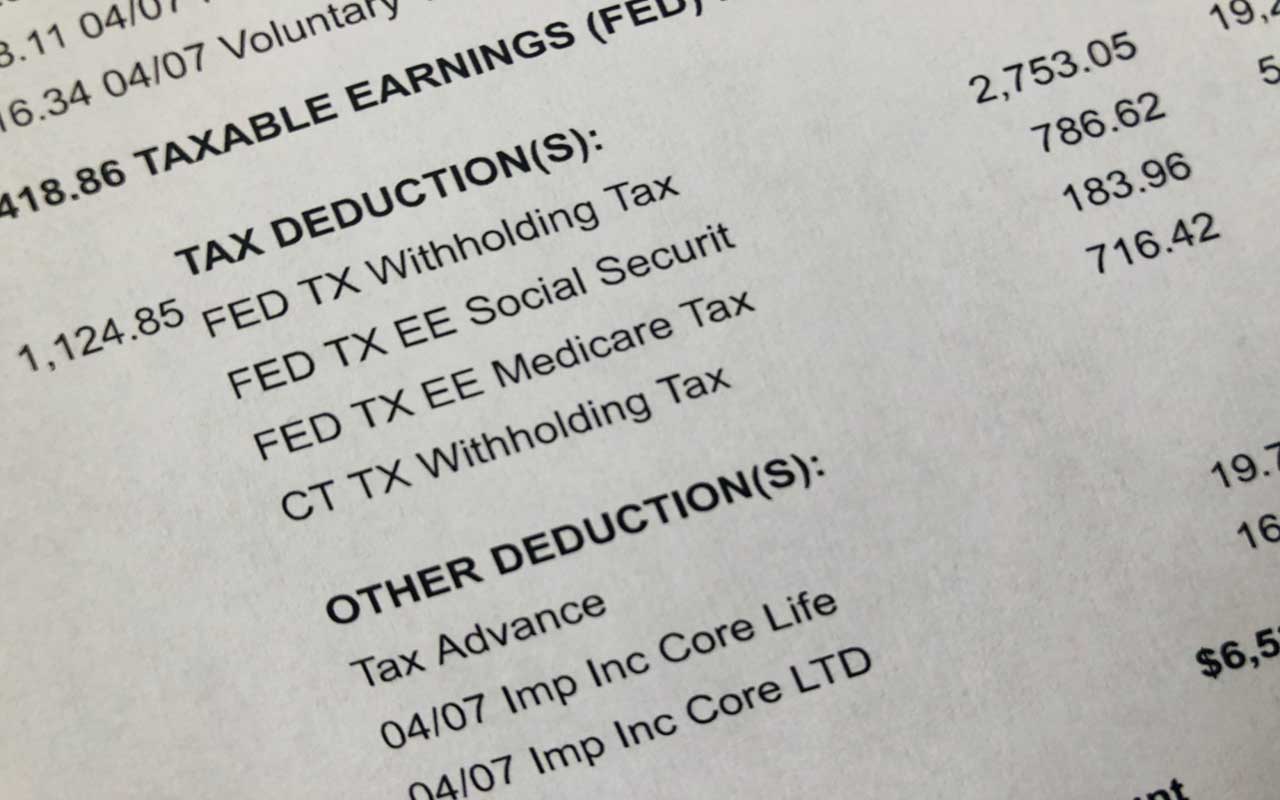

Employers can defer payment of their 6.2% share of Social Security tax on wages paid from March 27 through December 31, 2020. Half of the deferred amount is due on December 31, 2021, and the other half on December 31, 2022. Self-employed people can defer 50% of the self-employment tax they owe.

This relief does not apply to businesses that receive a Small Business Administration (SBA) paycheck protection loan under the CARES Act and have that debt forgiven for retaining their employees.

Payroll Tax Credit

There's a new payroll tax credit for employers hurt by the coronavirus…but the business must retain and continue to pay workers to claim this tax break. The credit of up to $5,000 per paid employee offsets the employer's 6.2% share of Social Security taxes, with the excess refundable. Eligible employers are those who have to close up shop or reduce hours because of a governmental order, or whose gross receipts in a quarter have declined by more than 50% compared to the same quarter in 2019.

The credit only applies to qualified wages paid from March 13 through December 31, 2020. Qualified wages depend on the number of employees the business had in 2019. If the firm averaged more than 100 full-time employees, qualifying wages are wages paid when employee services are not provided. For smaller firms, all wages are eligible for the credit.

Employers with cash flow problems can get this credit quickly by reducing employment tax deposits otherwise owed to the IRS by the amount of the credit. Firms can also file new IRS Form 7200 to seek advance payment for credits in excess of payroll tax deposits.

There are lots of rules and complexities involved with this payroll tax credit. One important restriction is that employers who get an SBA paycheck protection loan under the CARES Act are not eligible for the credit. So be sure to check with your tax advisor for assistance with this credit.

NOL Carrybacks Allowed

A business has a net operating loss (NOL) if its deductions for the year are more than its business income. Before 2018, businesses could carry back NOLs to the previous two tax years and carry them forward for up to 20 years. The 2017 tax reform law eliminated the two-year carryback for NOLs arising in taxable years ending after 2017 and allowed such NOLs to be carried forward indefinitely. The reform law also provided that NOL deductions can offset only up to 80% of taxable income for the year.

The CARES Act temporarily eases the tax reform law's NOL provisions. First, NOLs in 2018, 2019 and 2020 can now be carried back up to five years (the carryforward rule wasn't changed). Second, the 80% taxable income limit for utilizing NOLs is halted for 2018 through 2020.

Interest Deduction Expanded

The 2017 tax reform law limited the deduction that large firms can claim for interest on business debt to 30% of adjusted taxable income (ATI), with any disallowed interest carried forward. (The limit doesn't apply if a business's average annual gross receipts are $25 million or less for the three prior tax years. Also, certain regulated utility companies and real estate companies are exempt.) The CARES Act increases the 30% ATI limit. Net interest write-offs are now capped at 50% of ATI for 2019 and 2020. Firms can also use their 2019 ATI for figuring 2020 interest deductions.

Any business interest expense that isn't allowed as a deduction for the year is carried forward to the following year.

Business Loss Deduction Cap Suspended

The cap on the deduction for business losses on individual returns is halted. Under the 2017 tax reform law, the amount of trade or business losses that exceeded a $500,000 threshold for couples and $250,000 for other filers was nondeductible, with any excess carried forward. The CARES Act suspends this loss limitation rule generally for 2018 through 2020.

"Retail Glitch" Fixed

A key technical glitch in the 2017 tax reform law has been corrected. It involves depreciation for restaurant, retail and leasehold remodeling, which is consolidated under the grouping of qualified improvement property (QIP). As part of the 2017 tax reform law, Congress intended to give QIP a 15-year depreciable life and to make it eligible for 100% bonus depreciation. But the statutory language didn't reflect this intent. The CARES Act fixes this flub, retroactive to 2018.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.