9 Costly Mistakes Taxpayers Make

For as much as Americans complain about paying taxes, we sure leave a lot of money on the table—thanks to poor tax planning, sloppy filing and the sheer complexity of the tax code.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

For as much as Americans complain about paying taxes, we sure leave a lot of money on the table—thanks to poor tax planning, sloppy filing and the sheer complexity of the tax code. Last year, the IRS reported that it was holding on to $1 billion in unclaimed refunds for folks who didn't file a tax return in 2011.

Some taxpayer mistakes, such as providing the wrong Social Security number on your return, will simply delay processing of your return (and, potentially, your refund). But other mistakes, including the nine featured here, may cost you more than time. Plan ahead and take extra time with your return to avoid these expensive taxpayer errors.

Having Too Much Tax Withheld

Each year, about 75% of all workers receive tax refunds in the spring, proof positive that too much was withheld from their checks during the previous year. In so doing, you’ve given the government an interest-free loan when you could have been putting that money to work for you throughout the year.

To fix your withholding, just ask your company’s payroll office for a Form W-4, or download a W-4 form here. The more "allowances" you claim on the form, the less tax will be withheld. After you give a W-4 form claiming extra allowances to your employer (not the IRS), your take-home pay should rise on your next payday.

Exactly how many allowances should you claim? Answer our easy-to-use Tax Withholding Calculator’s three simple questions, and we'll estimate how many additional allowances you deserve. We'll even show you how much your take-home pay will rise starting on the next payday if you claim the allowances on a new W-4.

Failing to File—or at Least File an Extension

If you can’t get your act together by the April 18 deadline (April 19 if you live in Massachusetts or Maine), file for an extension via Form 4868. You can request the extension by phone, online or by mail. An extension will delay your filing deadline until October 15. It’s important to remember, though, that while an extension gives you more time to file, it doesn’t give you more time to pay what you owe. That isn’t a problem if you, like most taxpayers, are due a refund.

But if you owe, filing for an extension buys important protection. If you fail to pay the amount due with your request, you'll start racking up underpayment penalties of 0.5% a month on the unpaid amount, up to 25% of the unpaid balance, plus interest (currently 3%). Still, that's a lot better than the consequences of failing to file altogether, which entails a more onerous penalty of 5% a month on the unpaid amount, up to 25% of the unpaid balance, until the return is filed.

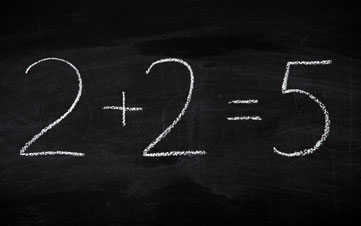

Making Math Errors

The IRS says math mistakes are some of the most common filing flaws. The IRS usually corrects these errors, but, in the meantime, your return (and refund) could be delayed. If a math error results in an underpayment, the IRS will require you to pay the additional amount, plus interest accrued since the due date of your return.

If you file on paper, double-check your math before you file. For e-filers, your tax software will do the math for you. (See Which Tax Software Is Best for You?)

Using the Wrong Status

This is another common error that can delay your refund. There are five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Filing as head of household? You must claim at least one dependent on your return. As married filing jointly? Be sure to include your spouse’s information on the return.

Using the wrong status could cause the IRS to reject your return, delaying your refund or triggering interest and penalties on the amount you owe.

This year, for the first time, same-sex couples who are legally married will be treated as married for purposes of filing their tax returns on the federal and state level. Previously, couples who lived in states that didn’t recognize same-sex marriage had to file as single individuals, even if they filed as married couples on their federal returns. Last June, the Supreme Court ruled that states were required to recognize same-sex marriages that were legally performed in another state, even if the state didn’t recognize same-sex marriages.

Failing to Report All of Your Income

If you worked for an employer last year, you probably had taxes withheld from your paycheck. But don’t overlook other sources of taxable income, such as gambling winnings, canceled debt and unemployment benefits. If you received a Form 1099-MISC from a casino or fantasy football Web site, the IRS received one, too. Ditto for 1099-DIV and 1099-INT forms from your financial institutions for income from savings and investment accounts. (See 9 Surprising Things That Are Taxable and our Is It Taxable? quiz to learn more.)

The IRS will adjust your return to reflect unreported income, and you could be hit with a penalty that’s equal to 20% of your underpayment. For example, if your omission caused you to understate your tax liability by $500, your penalty would be $100.

Allowing Double Taxation of Your Dividend Income

A former IRS commissioner told Kiplinger that missing out on this one break costs millions of taxpayers a lot in overpaid taxes.

If, like most investors, you have mutual fund dividends automatically used to buy extra shares, remember that each reinvestment increases your tax basis in the fund. That, in turn, reduces the taxable capital gain (or increases the tax-saving loss) when you redeem shares. Forgetting to include reinvested dividends in your basis results in double taxation of the dividends—once when they were paid out and immediately reinvested, and again when they are included in the proceeds of a sale.

If you're not sure what your basis is, ask the fund for help. (Funds must now report to investors the tax basis of shares redeemed during the year. For the sale of shares purchased in 2012 and later years, funds must also report the basis to the IRS.)

Forgetting About Last Spring's Payment

Did you owe state tax when you filed your 2014 returns in the spring of 2015? Then, for goodness' sake, remember to include that amount in your state-tax deduction on your 2015 federal return, along with state income taxes withheld from your paychecks or paid via quarterly estimated payments during the year.

Using the Wrong Bank Account Numbers

Direct deposit will allow you to get your refund more quickly, and you won’t have to worry about your check getting lost in the mail. Just make sure the account and routing numbers are correct. If your refund ends up in someone else’s account because of an incorrect account or routing number on your return, you’ll have to work with your financial institution to track it down, and there’s no guarantee you’ll find it. The IRS accepts no responsibility for misdirected refunds.

Waiting to File If You’re Due a Refund

How would you like to have to wait more than a year to get your income tax refund? It's possible, if a crook gets to your refund before you do by stealing your identity and filing a phony tax return. If someone files a return with your Social Security number before you do, your legitimate return will be stopped in its tracks. You'll be lucky to get things sorted out within 12 months.

Unfortunately, tax fraud via ID theft is a booming business. The IRS is stepping up its efforts to detect phony returns before checks are issued, but your best bet is to file your tax return before crooks have a chance to waylay your refund.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' Changes

When Do W-2s Arrive? 2026 Deadline and 'Big Beautiful Bill' ChangesTax Deadlines Mark your calendar: Feb 2 is the big W-2 release date. Here’s the delivery scoop and what the Trump tax changes might mean for your taxes.

-

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit Anxiety

Are You Afraid of an IRS Audit? 8 Ways to Beat Tax Audit AnxietyTax Season Tax audit anxiety is like a wild beast. Here’s how you can help tame it.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?