10 States With the Lowest Beer Taxes

If you want to get a brew that won't strain your wallet, consider pouring up in these 10 states.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

What’s better than beer? Not paying a lot of tax on it. In addition to paying the federal tax of up to $0.58 per gallon,* consumers must face the local excise tax for beer -- typically paid by brewers and distributors before the beer reaches store shelves, but nonetheless impacting the final cost of a cold brew.

State taxes on beer vary significantly in the U.S. -- Tennessee's top rate of $1.29 per gallon is more than 64 times higher than in Wyoming, where the levy is only $0.02 (and dates back to the end of prohibition). Beer being portable has led to cross-border shopping by some consumers. In some states, however, it may be illegal -- a form of bootlegging -- to return with beer purchased out-of-state.

If you want to get a brew that won’t strain your wallet, consider drinking in these 10 states with the lowest beer taxes.

*Federal beer taxes are lower for smaller breweries.

Massachusetts

- Beer: $0.11 per gallon

- Wine: $0.55 per gallon

- Liquor: $4.05 per gallon

- Go to Massachusetts's Full State Profile

Historians tell us the ships that carried the puritans arriving at Massachusetts Bay held more beer than water. With those sorts of priorities, it shouldn’t be surprising to see modern-day beer taxes kept low in the Bay State — the state tax on beer is only 11¢ per gallon. Plus, beer, wine and spirit connoisseurs living in or visiting Massachusetts will be happy to know that there’s no sales tax on alcohol purchases in the state, either.

Beyond Boston Beer Company's famous Founding Father-inspired lager, there are a handful of great craft options and microbreweries, many of which are making variants of the New England-bred "juicy" or "hazy" IPA, which downplays the bitterness typically found in IPAs, while upping the hop flavor and aroma. Tree House Brewing Company in Charlton specializes in this genre (well, and stouts). Offerings include the classic Julius, Haze (peach, orange and passionfruit notes), Sap (soft notes of grapefruit and mango) and Green (lemon-lime and pineapple flavors). Tree House only sells its beer on site.

Maryland

- Beer: $0.09 per gallon

- Wine: $0.40 per gallon

- Liquor: $1.50 per gallon

- Go to Maryland's Full State Profile

Despite landing on this list with a low 6¢ per gallon excise tax on beer, the “Old Line State” has a 9% alcohol-specific sales tax for beer (as opposed to the normal 6% state sales tax). That ultimately makes the cost of beer a little pricier.

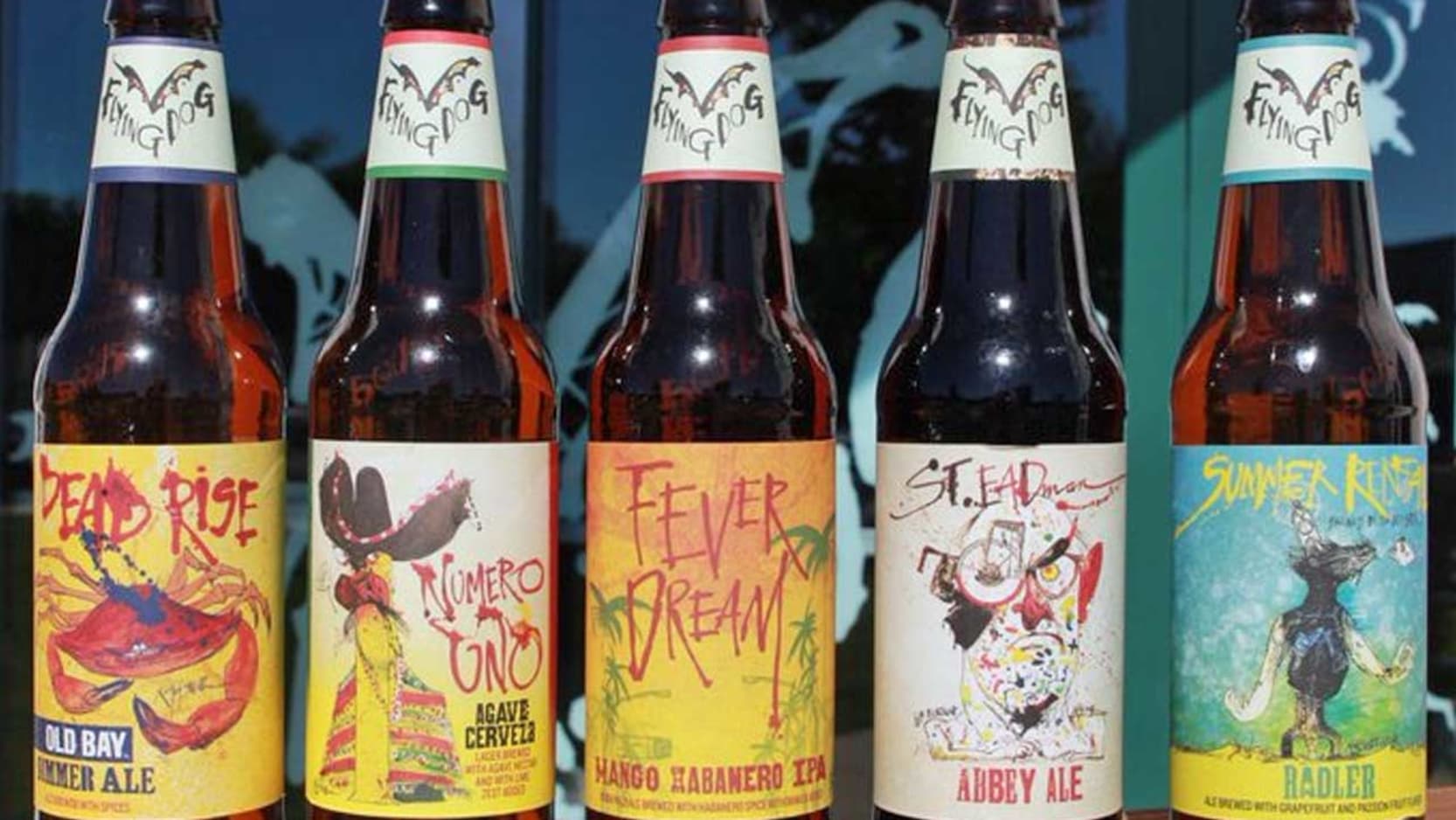

The beer scene in Maryland traces its roots to one of Baltimore’s first manufacturing industries, the brewing of National Bohemian beer or “Natty Boh” (still around, as a Pabst brand). But the scene is much more diverse now, with dozens of other breweries. The largest is Flying Dog, with nearly 30 beer offerings, including the controversially named Raging Bitch, a Belgian-style IPA.

Washington, D.C.

- Beer: $0.09 per gallon

- Wine: $0.30 per gallon

- Liquor: $1.50 per gallon

- Go to Washington, D.C.'s Full State Profile

While the beer tax in the District of Columbia is among the lowest in the country at only 9¢ per gallon, the city also charges a 10.25% tax on off-premise alcohol sales (10% for to-go sales or delivery with food). This includes a bottle of wine purchased at a grocery or liquor store, not a cold glass of lager at your favorite dive bar.

The nation’s capital experienced a bit of a brewing dry spell for the second half of the last century, but DC Brau filled the void in 2009 as the first packaging brewery the District had seen since 1956. And it wouldn’t be Washington if they didn’t have to get past some bureaucratic red tape first. DC Brau founders Brandon Skall and Jeff Hancock were instrumental in the legalization of on-site brewing sales and growler usage in D.C., paving the way for other breweries to follow.

Pennsylvania

- Beer: $0.08 per gallon

- Wine: No excise tax on in-store sales

- Liquor: $7.21 per gallon

- Go to Pennsylvania's Full State Profile

Every gallon of beer in Pennsylvania faces an 8¢ per gallon excise tax. But considering it’s one of the cheapest taxes in the country, you might not mind having to fork over the extra amount for your favorite brew.

The Keystone State has a rich history that also extends to its beer scene. In fact, the colony of Pennsylvania established breweries as early as 1683, making the tradition of drinking beer in America older than the establishment of America itself. Today, the state produces the most craft beer in the U.S., with more than 350 craft breweries. For a blast from the past, check out America’s oldest brewery, Yuengling. It’s located in the city of Pottsville, which is about a two-hour drive northwest of Philadelphia, and was launched nearly 200 years ago by a German immigrant.

Oregon

- Beer: $0.08 per gallon

- Wine: $0.67 per gallon

- Liquor: $21.95 per gallon

- Go to Oregon's Full State Profile

Oregon’s beer game is one of the top in the country, so the low tax is just an added perk. The state only adds 8¢ per gallon in excise taxes on beer, but it’s not as generous when it comes to spirits, which are taxed at nearly $22 per gallon. That might have something to do with why the state has about 300 breweries in operation. And Oregon drinkers are a loyal bunch: roughly two-thirds of all beer consumed in the state is made in Oregon.

It's hard to single out one gem among the many breweries that helped create the modern craft beer movement, but starting in Portland is one way to thin the herd. Upright, Breakside Brewery, and Wayfinder are all great picks. Breakside, an eclectic brewer known for its flagship IPA and hoppy ales, was crowned king of the state's beer scene after winning Brewery of the Year at the 2019 Oregon Beer Awards.

Kentucky

- Beer: $0.08 per gallon

- Wine: $0.50 per gallon

- Liquor: $1.92 per gallon

- Go to Kentucky's Full State Profile

Kentucky levies a modest 8¢ per gallon excise tax on beer production, but then adds a 10% wholesale tax on brewers. And while Kentucky’s distilleries outnumber its breweries by about 75 to 55, it still offers some great craft breweries. For example, Against the Grain Brewery (a fitting name, no?) opened its doors as Louisville’s first brewer-owned and operated brewery in 2011. The owners create unique beers in six main styles — session, hop, whim, malt, dark and smoke — and export to 43 U.S. states and more than 25 countries.

Colorado

- Beer: $0.08 per gallon

- Wine: $0.32 per gallon

- Liquor: $2.28 per gallon

- Go to Colorado's Full State Profile

Beer is such a staple in the Centennial State that the Brewers Association, a trade group for independent and craft brewers, is based in Boulder. Maybe that’s why the state’s beer excise tax is so low at only 8¢ per gallon.

And the state has no shortage of good options when it comes to breweries. In fact, five Colorado cities — Boulder, Fort Collins, Loveland, Denver and Longmont — were among the top 20 in the nation in breweries per capita, according to a 2019 study by C + R Research. Denver's Breckenridge Brewery takes its name from the ski town where it started (and still has a brewpub), but today has its main production facilities in Littleton.

Wisconsin

- Beer: $0.06 per gallon

- Wine: $0.07 per gallon

- Liquor: $3.25 per gallon

- Go to Wisconsin's Full State Profile

With a low 6¢ per gallon excise tax, Wisconsin only collected $8.5 million in tax revenue from beer sales last year, according to a report released by the state’s Department of Revenue. By comparison, liquor and wine sales generated nearly seven times that amount at $53.6 million.

Milwaukee, which is the largest city in the state, is the birthplace of Miller and Pabst — but it’s no stranger to the microbrewery trend. In fact, Milwaukee’s Lakefront Brewery, which opened in 1987, was the first U.S. brewery to bottle fruit beer since prohibition was repealed. It was also the first to bottle certified organic beer — and most notably, the first brewery to receive federal approval to brew gluten-free beer.

Missouri

- Beer: $0.06 per gallon

- Wine: $0.42 per gallon

- Liquor: $2 per gallon

- Go to Missouri's Full State Profile

The Show-Me State is all about putting your money where your mouth is – even if that’s barely more than a nickel. And it’s not just beer that gets a sweet deal with the state’s modest 6¢ per gallon excise tax. Missouri also has a relatively low excise tax on wine at only 42¢ per gallon.

Most people know St. Louis is home to beer giant Anheuser-Busch, but if you like your suds a bit less mass-marketed, try Schlafly Beer, the largest locally-owned independent craft brewery in Missouri.

Wyoming

- Beer: $0.02 per gallon

- Wine: $0.28 per gallon

- Liquor: $0.95 per gallon

- Go to Wyoming's Full State Profile

Granted, the home to Old Faithful has more geysers than breweries, but that doesn’t mean Wyomingites don’t know their way around a keg. And, at a mere 2¢ per gallon, Wyoming boasts the lowest excise tax for beer among the states featured on our list.

If you find yourself in Wyoming, consider Melvin Brewing, a favorite for IPA lovers. What started as a 20-gallon system in the back of a Jackson Hole Thai restaurant grew into a 30-barrel system serving beers all over the West Coast.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Medler is a senior at Stanford University, majoring in Political Science and Communications. An intern finding her way in the professional world, she has quite the hodgepodge of communications experience — from reporting at the St. Louis Business Journal and The Riverfront Times, to working in politics, advertising, and even comedy at the television show Full Frontal with Samantha Bee. She also writes and edits for various campus publications including The Stanford Daily and Stanford Politics. Medler became a Kiplinger intern through the American Society of Magazine Editors Internship Program.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

3 Major Changes to the Charitable Deduction for 2026

3 Major Changes to the Charitable Deduction for 2026Tax Breaks About 144 million Americans might qualify for the 2026 universal charity deduction, while high earners face new IRS limits. Here's what to know.

-

Retirees in These 7 States Could Pay Less Property Taxes Next Year

Retirees in These 7 States Could Pay Less Property Taxes Next YearState Taxes Retirement property tax bills could be up to 65% cheaper for some older adults in 2026. Do you qualify?

-

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?

Estate Tax Quiz: Can You Pass the Test on the 40% Federal Rate?Quiz How well do you know the new 2026 IRS rules for wealth transfer and the specific tax brackets that affect your heirs? Let's find out!

-

5 Types of Gifts the IRS Won’t Tax: Even If They’re Big

5 Types of Gifts the IRS Won’t Tax: Even If They’re BigGift Tax Several categories of gifts don’t count toward annual gift tax limits. Here's what you need to know.