Will Congress Say Yes to a Second Stimulus Check?

All the key lawmakers say they want another stimulus package, but don't start planning how you're going to spend a second stimulus check quite yet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

People want to know if they're going to get a second stimulus check. At this point, it's uncertain if Congress will pass another stimulus bill while President Trump is still in office, or punt on the matter until presumptive President-elect Joe Biden is sworn in in late January. All sides – congressional Democrats and Republicans, and President Trump – say they want a deal. But the November elections failed to loosen the months-long standoff on what the overall price tag for another stimulus package should be, which is the biggest sticking point.

Odds of a Second Stimulus Check are Not Good

Here's one thing you can be fairly certain of, though: If and when Congress reaches a deal, the bill is unlikely to include a second stimulus check provision. The roughly $2 trillion CARES Act passed this spring included money for direct payments to most taxpayers, but lawmakers don't have any appetite for an encore now. So, don't start planning how you're going to spend a second stimulus check quite yet.

McConnell is the Key

Democrats are pushing for a bill in the neighborhood of $2 trillion, while Republicans want a measure costing half that much, or less. Senate Majority Leader Mitch McConnell (R-KY) said recently that, with unemployment numbers decreasing and the economy improving, there's no need for a multitrillion-dollar package. McConnell insists that any bill must be "highly targeted" to specific needs, particularly to help businesses. As long as his party retains control of the Senate next year, it'll be tough to get around him. Yet Democrats want a more broad-reaching measure, including money for local and state governments financially strained due to the pandemic. And, so far, no one appears ready or willing to budge.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, how would Biden handle the issue if it slips to his watch? For one thing, he would be much more hands-on during negotiations than Trump. Biden revels in one-on-one personal dealings. And his long working relationship with McConnell would help, particularly since the Senate majority leader wouldn't have to worry about pleasing President Trump anymore. Still, the pair's professional relationship is no guarantee for success.

One possible compromise could be a series of smaller targeted bills, spread out over weeks or months. This approach would be easier for Republicans to stomach. But with much of the public clamoring for additional help immediately, Washington may be compelled to act sooner rather than later, with one broad bill. Even if that happens, though, don't look for a second stimulus check or direct deposit in your bank account from Uncle Sam.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Sean Lengell covers Congress and government policy for The Kiplinger Letter. Before joining Kiplinger in January 2017 he served as a congressional reporter for eight years with the Washington Examiner and the Washington Times. He previously covered local news for the Tampa (Fla.) Tribune. A native of northern Illinois who spent much of his youth in St. Petersburg, Fla., he holds a bachelor's degree in English from Marquette University.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Kiplinger's Tax Map for Middle-Class Families: About Our Methodology

Kiplinger's Tax Map for Middle-Class Families: About Our Methodologystate tax The research behind our judgments.

-

Retirees, Make These Midyear Moves to Cut Next Year's Tax Bill

Retirees, Make These Midyear Moves to Cut Next Year's Tax BillTax Breaks Save money next April by making these six hot-as-July tax moves.

-

Estimated Payments or Withholding in Retirement? Here's Some Guidance

Estimated Payments or Withholding in Retirement? Here's Some GuidanceBudgeting You generally must pay taxes throughout the year on your retirement income. But it isn't always clear whether withholding or estimated tax payments is the best way to pay.

-

How to Cut Your 2021 Tax Bill

How to Cut Your 2021 Tax BillTax Breaks Our guidance could help you claim a higher refund or reduce the amount you owe.

-

Why This Tax Filing Season Could Be Ugly

Why This Tax Filing Season Could Be UglyCoronavirus and Your Money National Taxpayer Advocate Erin M. Collins warns the agency will continue to struggle with tight budgets and backlogs. Her advice: File electronically!

-

Con Artists Target People Who Owe The IRS Money

Con Artists Target People Who Owe The IRS MoneyScams In one scheme, thieves will offer to "help" you pay back taxes, only to leave you on the hook for expensive fees in addition to the taxes.

-

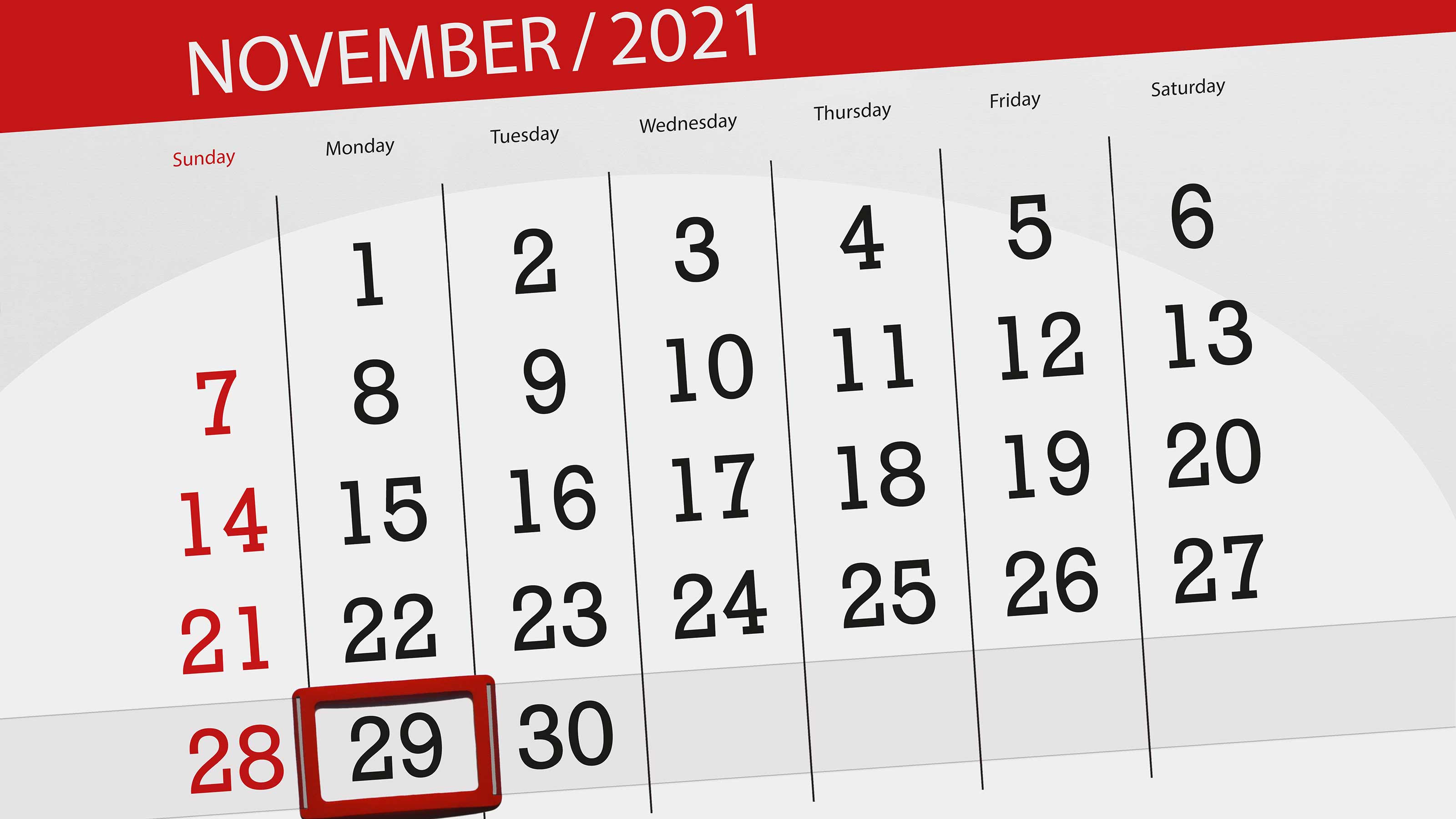

Final Child Tax Credit Payment Opt-Out Deadline is November 29

Final Child Tax Credit Payment Opt-Out Deadline is November 29Tax Breaks The due date for opting out of the December 15 monthly child credit payments is almost here. Missing the deadline could cost you in the long run.

-

Child Tax Credit Payment Deadline: Get Up to $1,800 Per Child If You Act Today

Child Tax Credit Payment Deadline: Get Up to $1,800 Per Child If You Act TodayTax Breaks There's only a few hours left for people who normally don't need to file a tax return to sign up for an advance child tax credit payment.