How Your Third Stimulus Check Will Differ From the First Two Payments

We're oh so close to getting a third stimulus check. But the amount and eligibility rules for your next stimulus payment will be different than for earlier ones.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A third stimulus check can't arrive soon enough for people who are struggling financially. But even though we're oh so close to seeing that happen, we're not quite there yet. On Saturday, the Senate passed President Biden's American Rescue Plan, which authorizes a third round of stimulus checks. However, the House of Representatives still has to approve changes made to the plan by the Senate before the president can sign the bill into law. That's all expected to happen this week, which means some people potentially could receive a third stimulus check as early as next week.

While your third stimulus check will look a lot like your first (CARES Act) and second (COVID-Related Tax Relief Act) stimulus payments, there are several important differences. The amount, for one, won't be the same. Eligibility for a third stimulus check will be different, too. So that you're not caught off guard, let's take a look at the expected third-round stimulus checks and see how they differ from payments under the CARES Act and the COVID-Related Tax Relief Act. You might benefit more from your third-round stimulus check than you did from your first two payments. But you won't know unless you read on!

Larger Base Amount for Third Stimulus Checks

The base amount of first-round stimulus checks under the CARES Act was $1,200 (i.e., the amount paid before adding the extra payment for children or applying the phase-out rules). That amount was cut down to $600 for second-round payments under the COVID-Related Tax Relief Act. But the base amount for third-round stimulus payments will be higher than either the first- or second-round payments.

The base amount for your third stimulus check will be $1,400. President Biden and Senate Democrats settled on that amount because many Americans thought the $600 second-round checks were insufficient and that they should have been for $2,000. However, not every lawmaker was willing to go that far and support an additional round of $2,000 stimulus checks. So, instead, the idea of authorizing a combined total equaling $2,000 was born ($600 second-round checks + $1,400 third-round checks = $2,000). In fact, the House even passed a bill in December – the CASH Act – that would have done just that, although it was blocked by Republicans in the Senate and never became law.

Families Will Get More Added to Their Third Stimulus Check

For first-round stimulus payments, families received an extra $500 for each dependent child age 16 or younger. That amount was increased to $600 for second-round payments. (The extra payments were in addition to the base amount of $1,200 or $600, respectively.)

The additional amount for dependents will be significantly higher for third-round checks – $1,400 per eligible dependent. Again, this amount has its roots in the CASH Act, which would have increased the second-round extra payment from $600 to $2,000 per eligible child. That bill showed us that Democratic lawmakers were willing to give more to families with kids.

More Families Will Get an Extra Amount in Their Third Stimulus Check

For both the first- and second-round stimulus payments, families received an additional $500 or $600, respectively, for each dependent child age 16 or younger (see above). However, families with older children, including college students age 23 or younger, or with elderly parents living with them, got nothing. Zero. Zip. Zilch. That will change with third-round stimulus checks.

Under the American Rescue Plan, all dependents will qualify for the extra $1,400 payment – regardless of their age. (Of course, the person claiming the dependent on his or her tax return will actually get the additional $1,400 – it won't go to the dependent.) This change means many more families will see an extra amount tacked on to their stimulus check this time around than under the first two rounds of payments.

Fewer People Will Qualify for a Third Stimulus Check

Wealthier Americans didn't get a first- or second-round stimulus check. That's because payments were gradually decrease to zero if the adjusted gross income (AGI) reported on your 2018 or 2019 tax return was above a certain amount. That happened for single filers with an AGI above $75,000. Married couples filing a joint return started to see their previous stimulus checks shrink if their AGI exceeded $150,000. For people who claimed the head-of-household filing status, payments were reduced if your AGI topped $112,500.

However, that still means a lot of families with higher incomes – and who may not have suffered financially during the pandemic – still received something during the first two rounds of stimulus payments. That's especially true for families with children. For example, a family of five with a 2019 AGI up to $228,000 still got a first-round stimulus check (although it would be a small one). For the second-round payments, a family of five got a check if their 2019 AGI didn't exceed $210,000.

Third-round stimulus checks will be more "targeted" to families that are more likely to be hurting financially. This is accomplished by dramatically increasing the rate at which payments are "phased out" (i.e., reduced). The phase-out thresholds will be the same for third-round stimulus checks as they were for previous stimulus payments – you'll still get a full payment if your AGI doesn't exceed $75,000 (singles), $112,500 (head-of-household filers), or $150,000 (joint filers). However, singles with an AGI above $75,000 will see their third stimulus checks gradually reduced until they reach zero for anyone making $80,000 or more. For head-of-household filers, the phaseout range would be from $112,500 to $120,000. For joint filers, it's $150,000 to $160,000.

There's also a firm income limit in place for third-round stimulus checks that didn't exist for earlier payments. With the first- and second-round payments, the point at which a person's payment would be reduced to zero depended in part on the number of dependent children in the family who were 16 years old or younger. For example, a married couple with no children had their second stimulus check reduced to zero if their AGI was $174,000 or more. However, if that couple had one child, their second-round check wasn't completely phased out unless their AGI was $186,000 or more.

For the upcoming round of stimulus checks, the phase-out range's ceiling will be a hard cap that applies to all people, regardless of how many dependents they have. As a result, third stimulus checks will be reduced to zero for all taxpayers at or above the $80,000, $120,000, and $160,000 AGI levels (depending on your filing status).

Third Stimulus Checks Will Be Based on 2019 or 2020 Tax Returns

First-round stimulus checks were based on either your 2018 or 2019 tax return, whichever was most recently filed when the IRS began processing your return. If you didn't file a return for either of those two years, you could send the IRS the necessary information through an online portal. If you received benefits from the Social Security Administration, Railroad Retirement Board, or Department of Veterans Affairs, the IRS got the information it needed from those other government agencies. If the IRS didn't get your information at all, you can claim the amount due as a Recovery Rebate credit on your 2020 federal tax return (Form 1040).

Second stimulus checks were based on your 2019 return. If you didn't file a return, you didn't use the non-filers portal to get your first-round payment, and you don't receive government benefits, then you can claim the Recovery Rebate credit on your 2020 return to get your money. The IRS didn't use the non-filer portal for second stimulus payments.

The IRS began accepting 2020 tax returns on February 12. Since some people have already filed their 2020 return and some people haven't, eligibility for and the amount of your third stimulus check will be based on either your 2019 or 2020 return. According to the American Rescue Plan, if your 2020 tax return isn't filed and processed by the time the IRS starts processing your third stimulus payment, the tax agency will use information from your 2019 tax return. If your 2020 return is already filed and processed when the IRS is ready to send your payment, then your stimulus check eligibility and amount will be based on information from your 2020 return. If your 2020 return is filed and/or processed after the IRS sends you a stimulus check, but before July 15, 2021 (or September 1 if the April 15 filing deadline is pushed back), the IRS will send you a second payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return.

As with first-round payments, this creates opportunities to "game" the system if you haven't already filed your 2020 return. For instance, if you'll get a larger check based on your 2020 tax return, than you might be able to quickly file your 2020 return electronically and have your third stimulus check based on that return. If you'll get a bigger check if it's based on your 2019 return, then just wait until after your payment is processed to file your 2020 return. (Use our Third Stimulus Check Calculator to run the numbers under both your 2019 and 2020 returns.)

For more on how to time your tax return to maximize your payment, see How Filing Your Tax Return Early (or Late) Could Boost Your Third Stimulus Check.

Child Support Won't Be Taken From Third Stimulus Checks

If you were behind on child support payments when first-round stimulus checks were being sent, the IRS could have taken your stimulus money and given it to the person you owed. As it turns out, the IRS went a bit too far and ended up taking stimulus payments from about 50,000 spouses of people who owed child support to a third person. They paid that money back, though.

Congress reversed course for the second round of stimulus checks. Under the COVID-Related Tax Relief Act, the IRS can't take second-round payments to pay overdue child support.

As with second-round checks, third stimulus checks won't be reduced to pay child support arrears. So, there is a difference between first-round payments and third-round checks.

There Will Be Fewer Protections Against Garnishment

The COVID-Related Tax Relief Act prevented garnishment of second-round stimulus checks by creditors or debt collectors. They couldn't be lost in bankruptcy proceedings, either. The IRS also had to encode direct deposit second-round payments so that banks knew they couldn't be garnished. This is in contrast with the CARES Act, which didn't provide similar protections for first-round payments.

Under the American Rescue Plan, your payment will be protected from reduction or offset to pay federal taxes, state income taxes, debts owed to federal agencies, and unemployment compensation debts. (As well as child support, as was discussed above.) However, as with first-round checks under the CARES Act, there will be no additional protections against garnishment by private creditors or debt collectors for third-round payments. There's nothing in the American Rescue Plan to stop creditors from getting your third stimulus check in bankruptcy proceedings, either.

People Who Died in 2020 Won't Receive a Third Stimulus Check

The CARES Act didn't say anything about whether deceased people should or shouldn't receive a stimulus check. Lawmakers probably just didn't think about it. As a result, as the IRS rushed to deliver payments as soon as possible, over 1 million first-round stimulus checks were sent to people who were dead. The IRS later asked for the money back, but it's not clear how many family members followed the tax agency's instructions and sent the money back.

When it came time to draft the COVID-Related Tax Relief Act, Congress was a little more careful. They included a provision in that law specifically saying that anyone who died before January 1, 2020, was not eligible to receive a second stimulus check. In addition, the IRS was granted access to the Social Security Administration's "death master file," which was supposed to cut down on the number of second-round stimulus checks inadvertently sent to people who are no longer with us.

For third-round stimulus checks, rules similar to those in place for the second round of payments will apply, but the date of death defining eligibility will be January 1, 2021. As a result, people who died in 2020 or earlier won't qualify for a third-round payment.

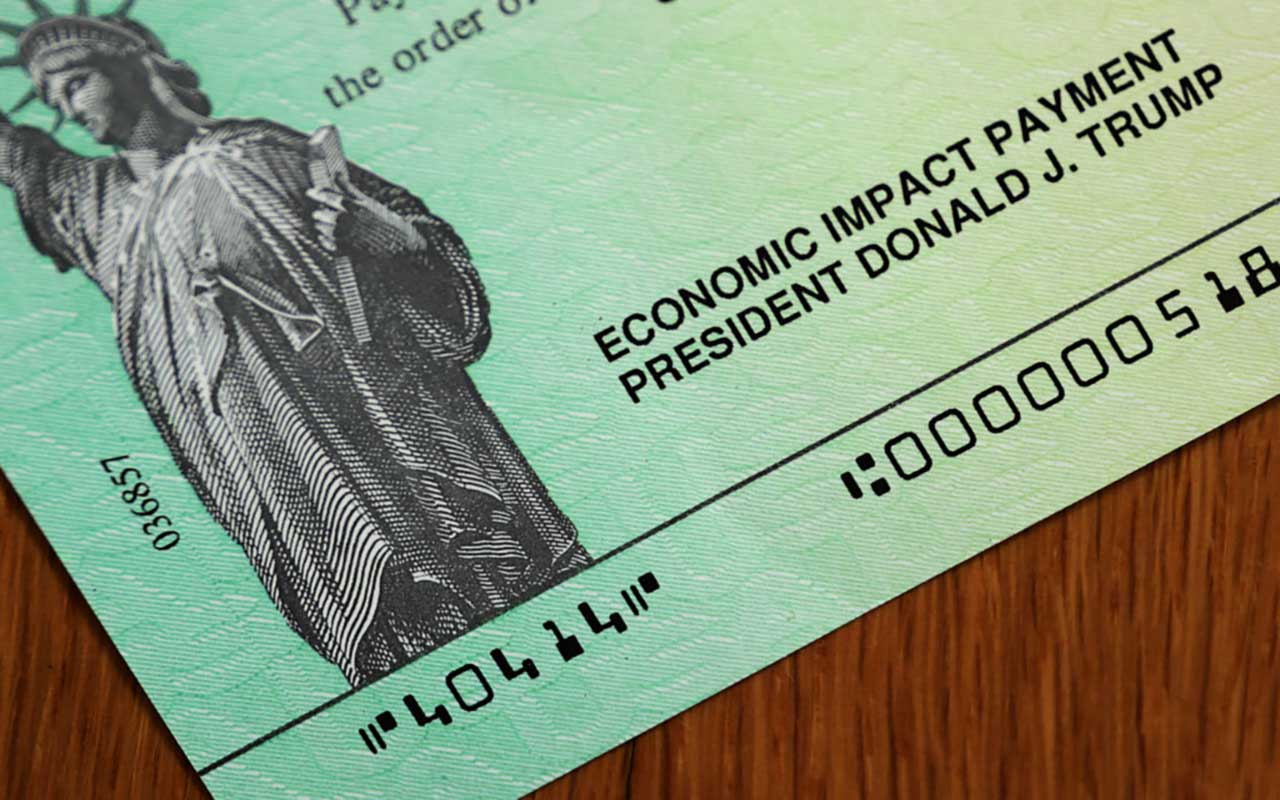

The President's Name Won't Appear on Third Stimulus Checks

Former President Trump's name (but not signature) appeared on earlier stimulus checks issued by the IRS. That created quite a stir among Democratic lawmakers, who accused the former president of trying to take all the credit for the stimulus payments.

President Biden will take a different path. According to White House Press Secretary Jen Psaki, "the President's name will not appear on the memo line of this round of stimulus checks."

Stay on Top of Stimulus Check Developments

Follow Kiplinger for the latest news and insights on federal stimulus payments (and other important personal-finance matters). Stay with us on:

- email. Sign up free for our daily Kiplinger Today e-newsletter.

- social media. Follow us on Instagram, Twitter and Facebook.

- podcasts. Subscribe free to our weekly Your Money's Worth podcast. Apple | Google Podcasts | Spotify | Overcast

See some of our other coverage of President Biden's American Rescue Plan:

- The Current Plan for a $1,400 Third Stimulus Check

- Third Stimulus Check Calculator

- How Filing Your Tax Return Early (or Late) Could Boost Your Third Stimulus Check

- Senate Passes $3,000 Child Tax Credit for 2021

- 2021 Child Tax Credit Calculator

- Senate Alters Unemployment Benefits Before Passing Stimulus Package

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

States That Tax Social Security Benefits in 2026

States That Tax Social Security Benefits in 2026Retirement Tax Not all retirees who live in states that tax Social Security benefits have to pay state income taxes. Will your benefits be taxed?

-

New Law Delivers Tax Breaks to Natural Disaster Victims, But Is It Enough?

New Law Delivers Tax Breaks to Natural Disaster Victims, But Is It Enough?Tax Relief The legislation provides critical tax relief to thousands of natural disaster victims across the country.

-

A Look at Kamala Harris's Tax Plans Ahead of the Election

A Look at Kamala Harris's Tax Plans Ahead of the ElectionThe Tax Letter Under Harris's tax proposals, upper-income individuals would pay more taxes, while the middle class and lower-income people would pay less.

-

More People Are Paying This Tax On Investment Income Each Year: Kiplinger Tax Letter

More People Are Paying This Tax On Investment Income Each Year: Kiplinger Tax LetterTax Letter The number of returns reporting the net investment income tax has more than doubled and revenue from the tax has grown by $38 billion over the past decade.

-

IRS Loses About $21 Billion Due to Debt Limit Deal: Kiplinger Tax Letter

IRS Loses About $21 Billion Due to Debt Limit Deal: Kiplinger Tax LetterKiplinger Tax Letter Only time will tell the impact of a key budget concession involving the IRS.

-

Ten States with the Lowest Sales Tax in 2025

Ten States with the Lowest Sales Tax in 2025Sales Tax Living in one of the lowest sales tax states doesn't always mean you'll pay less.

-

Biden Wants a Higher Child Tax Credit and So Do Some Republicans

Biden Wants a Higher Child Tax Credit and So Do Some RepublicansPresident Biden wants to revive the higher child tax credit and monthly advance payments, while some Republican senators have their own ideas for the popular tax break.

-

Biden Calls for Doubling Capital Gains Tax

Biden Calls for Doubling Capital Gains TaxThe White House President Biden wanted to increase taxes to have the wealthy pay a “fairer” share. Will VP Kamala Harris follow?