11 Surprising Things That Are Taxable

If you picked up any of the income or property on our list, make sure you declare it on your next tax return.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you work for a living, you know that your wages are taxable, and you're probably aware that some investment income is taxed, too. But, unfortunately, the IRS doesn't stop there.

If you've picked up some extra cash through luck, skill or even criminal activities, there's a good chance you owe taxes on that money as well. To avoid being caught off guard when it's time to file your return, take a look at our list of 11 surprising things that are actually taxable. If you collected any of the income or property on the list, make sure you declare it on your next tax return!

Scholarships

If you receive a scholarship to cover tuition, fees and books, you don't have to pay taxes on the money. But if your scholarship also covers room and board, travel and other expenses, that portion of the award is taxable.

Students who receive financial aid in exchange for work, such as serving as a teaching or research assistant, must also pay tax on that money, even if they use the proceeds to pay tuition.

Gambling Winnings

What happens in Vegas doesn't necessarily stay in Vegas. Gambling income includes (but isn't limited to) winnings from lotteries, horse races, casinos and sports betting (including fantasy sports). The payer is required to issue you a Form W2-G (which will also be reported to the IRS) if you win $1,200 or more from bingo or slot machines, $1,500 or more from keno, more than $5,000 from a poker tournament, or $600 or more from other wagers if your take is more than 300 times the amount of your bet. But even if you don't receive a W2-G, the IRS expects you to report your gambling proceeds on your tax return.

The good news: If you itemize, your gambling losses are deductible, but only to the extent of the winnings you report as income. For example, if you won $4,000 last year and had $5,000 in losing bets, your deduction for the losses is limited to $4,000. You can't deduct the balance against other income or carry it forward.

Your state may want a piece of the action, too. Your home state will generally tax all your income (if it has an income tax) — including gambling winnings. But also watch out for a tax bill if you place a winning bet in another state. You won't be taxed twice, though. The state where you live should give you a tax credit for the taxes you pay to the other state. Also, check to see if your state allows a deduction for gambling losses.

Unemployment Benefits

Millions of Americans have received unemployment compensation during the pandemic – many for the first time. While these benefits provide an important lifeline during tough times, they could also produce an unexpected tax bill.

Unemployment benefits are a form of income, and that income is generally taxable at the federal level. In some cases, state taxes are due on unemployment benefits, too. (State treatment varies, so check out our State-by-State Guide to Taxes on Unemployment Benefits to see what your state does.) According to the IRS, unemployment compensation, for the most part, includes any amounts received under federal or state unemployment compensation laws, including state unemployment insurance benefits and benefits paid to you by a state or the District of Columbia from the Federal Unemployment Trust Fund.

You have the option to have as much as 10% of your weekly benefits withheld for federal taxes. Taxpayers will receive a Form 1099-G from the IRS, which shows the amount received and the amount of any federal income tax removed from your benefits. Taxes may be withheld from unemployment benefits at the request of the benefits claimant by using Form W-4V, while others who choose not to have their taxes withheld may need to make estimated tax payments during the year.

Cancelled Debt

Don't get too excited if a credit card company says you don't have to pay off the rest of your balance. That's because debt that is cancelled or otherwise discharged for less than the amount you owe is generally treated as taxable income. This applies to credit card bills, car loans, mortgages, or any other debt that you owe. So, for example, if your bank says you don't have to pay $2,000 of the $6,000 you still owe on a car loan, you have $2,000 of cancellation of debt income that you must report on your next tax return.

There are some exceptions to the general rule, such as for student loans, debts discharged in bankruptcy, qualified farm indebtedness and a few other types of debt. Also, in the case of "nonrecourse" debt — i.e., where the lender can repossess any collateral property if you fail to pay, but you're not personally liable for the unpaid debt — any cancelled debt is not considered taxable income (although you might realize gain or loss from the repossession).

If you do have a debt forgiven, the creditor may send you a Form 1099-C showing the amount of cancelled debt. The IRS will get a copy of the form, too — so don't think Uncle Sam won't know about it.

Stolen Property

If you robbed a bank, embezzled money or staged an art heist last year, the IRS expects you to pay taxes on the proceeds. "Income from illegal activities, such as money from dealing illegal drugs, must be included in your income," the IRS says. Bribes are also taxable.

In reality, few criminals report their ill-gotten gains on their tax returns. But if you're caught, the feds can add tax evasion to the list of charges against you. That's what happened to notorious gangster Al Capone, who served 11 years for tax evasion. Capone never filed a tax return, the IRS says.

Buried Treasure

In September 2020, a man found a 9-carat diamond in the Crater of Diamonds State Park in Pike County, Arkansas. It was the second-largest diamond ever found in the park and could be worth more than $1 million.

But be aware that if you find a diamond in the rough, unearth a cache of gold coins in your backyard or discover sunken treasure while deep-sea diving, the IRS wants a piece of your booty. Found property is taxable at its fair market value in the first year it's your undisputed possession, the IRS says.

The precedent for the IRS's "treasure trove" rule dates back to 1964, when a couple discovered $4,467 in a used piano they had purchased for $15. The IRS said the couple owed income taxes on the money, and a U.S. District Court agreed.

Gifts from Your Employer

Ordinarily, gifts aren't taxable, even if they're worth a lot of money. But if your employer gives you a new set of golf clubs to recognize a job well done (or to persuade you to reject a job offer from a competitor), you'll probably owe taxes on the value of your new irons.

More than 50 years ago, the Supreme Court ruled that a gift from an employer can be excluded from the employee's income if it was made out of "detached and disinterested generosity." Gifts that reward an employee for his or her services don't meet that standard, the court said. Gifts that help promote the company don't meet that standard, either.

Bitcoin

While you can use bitcoin to purchase a variety of goods and services, the IRS considers bitcoin — along with other cryptocurrencies — to be an asset. If the bitcoin you used to make a purchase is worth more than you paid for it, you're expected to pay taxes on your profits at capital gains rates — just like stocks and bonds.

Also be warned that, as the use of cryptocurrency increases, the IRS is starting to pay more attention to it. For instance, since 2019, the tax agency has been sending letters to people who may not have reported transactions in virtual currencies. Plus, the 2021 Form 1040 includes a line asking taxpayers if they received, sold, sent, exchanged or otherwise acquired any financial interest in any virtual currency during the tax year.

Some cryptocurrency platforms are sending investors statements that provide a record of their transactions. But even if you didn't get a statement, you're responsible for paying taxes on your crypto gains.

If your employer pays you in bitcoin or some other virtual currency, it must be reported on your W-2 form, and you must include the fair market value of the currency in your income. It's also subject to federal income tax withholding and payroll taxes.

Bartering

When you exchange property or services in lieu of cash, the fair market value of the goods and services are fully taxable and must be included as income on Form 1040 for both parties. But an informal exchange of similar services on a noncommercial basis, such as carpooling, is not taxable.

If you exchanged property or services through a barter exchange, you should expect to receive a Form 1099-B (or a similar statement) in the mail. It will show the value of cash, property, services, credits or scrip you received from bartering.

Payment for Donated Eggs

Every year, thousands of young, healthy women donate their eggs to infertile couples. Payments for this service generally range from $6,500 to $30,000, according to Egg Donation, Inc., a company that matches donors with couples. Those payments are taxable income, according to the U.S. Tax Court. Fertility clinics typically send donors and the IRS a Form 1099 documenting the payment.

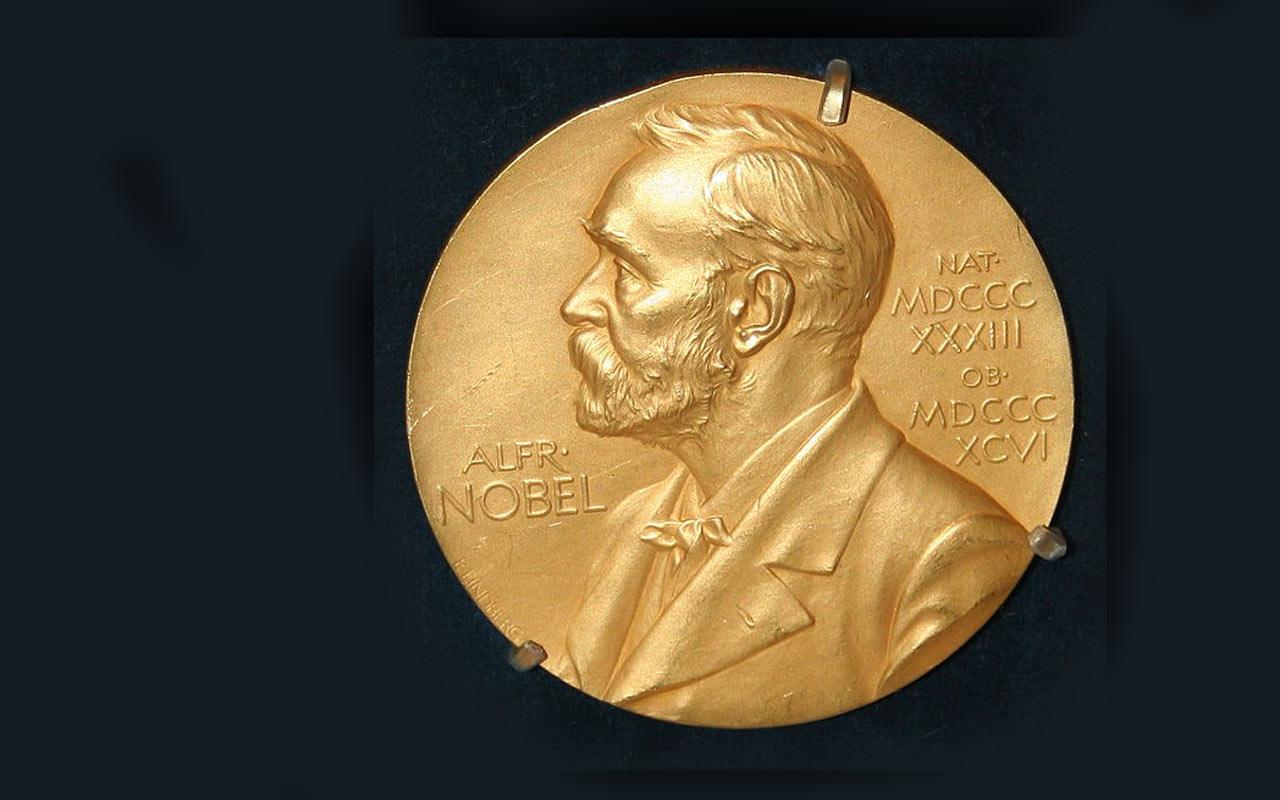

The Nobel Prize

If you were selected for this prestigious honor — worth about $1.1 million in 2021 — you must pay taxes on it.

Other awards that recognize your accomplishments, such as the Pulitzer Prize for journalists, are also taxable. The only way to avoid a tax hit is to direct the money to a tax-exempt charity before receiving it. That's what President Obama did when he was awarded the Nobel Peace Prize in 2009. If you accept the money and then give it to charity, you probably will have to pay taxes on some of it because the IRS ordinarily limits charitable deductions to 60% of your adjusted gross income (for the 2021 tax year, under a provision in the CARES Act, you can deduct donations of up to 100% of your AGI to charity).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.