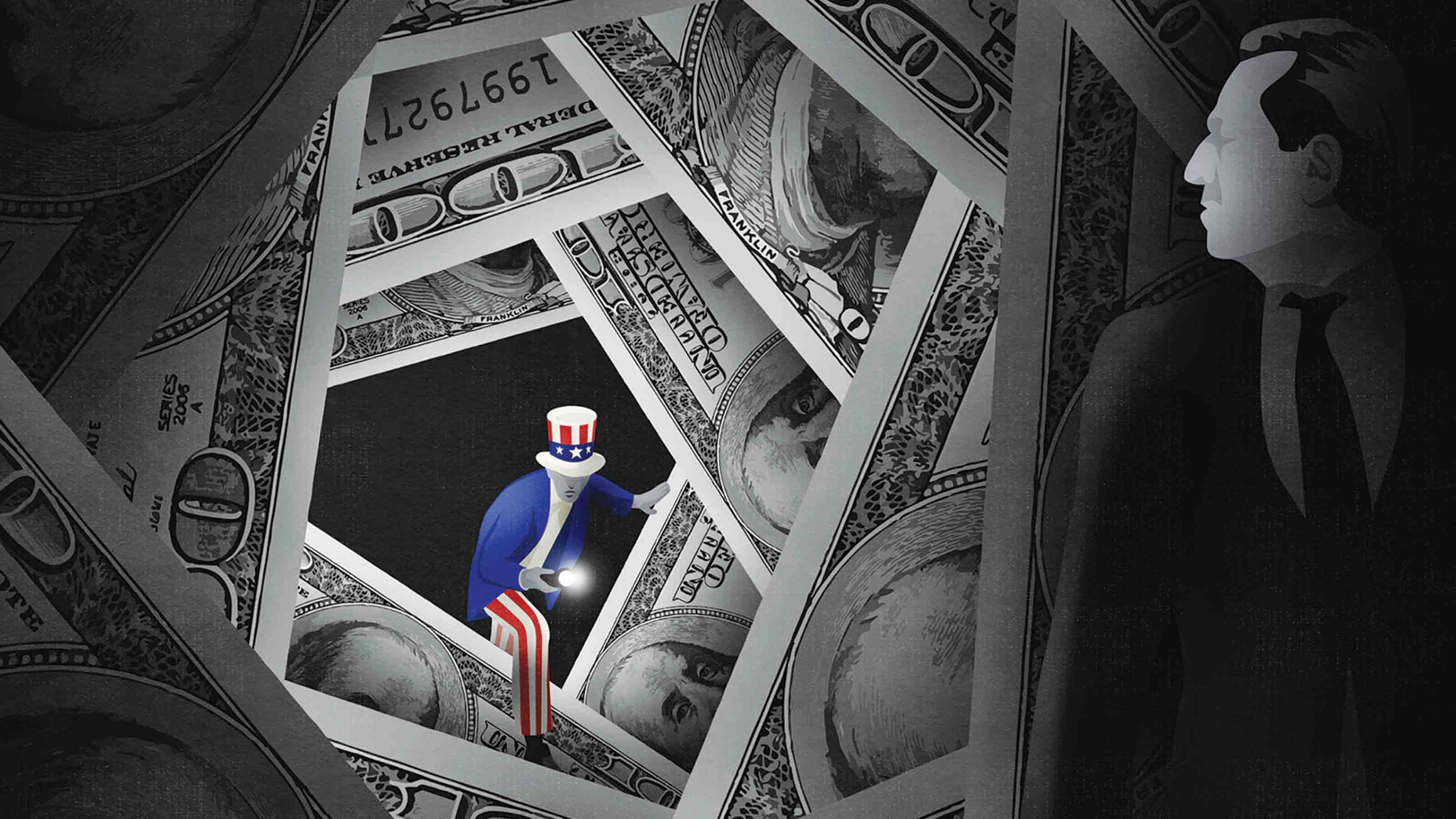

IRS Plans to Track Down Tax Cheats

The proposal targets high-income taxpayers, but enforcement wouldn’t be limited to the top 1%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

At a time when Americans are deeply polarized on many issues, the need to crack down on tax scofflaws is one topic that probably won’t trigger a Thanksgiving dinner squabble. Lawmakers like the idea, too, because narrowing the tax gap—the difference between the total taxes owed and the amount that goes unpaid—could fund billions of dollars in government spending on infrastructure, child care and other initiatives. Estimates of the size of the tax gap vary, but IRS Commissioner Chuck Rettig made headlines earlier this year when he estimated that it exceeds $1 trillion annually. When it comes to specifics, though, some proposals to recover outstanding taxes could give even honest taxpayers pause, particularly if they have privacy concerns.

The Biden administration has proposed increasing the IRS budget by $80 billion over the next decade, which would fund, among other things, the cost of hiring 5,000 new enforcement agents. The administration has emphasized that the proposed increase in audits, which have plummeted in recent years, would focus on large corporations and individuals who earn more than $400,000 a year.

Unlike taxpayers who have taxes withheld from their paychecks, wealthy individuals tend to earn more of their income from investments and other “non-labor” sources that aren’t subject to withholding. But if you’re self-employed or have invested in cryptocurrency, measures to reduce the tax gap could affect you even if you earn less than $400,000 a year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Too much information? In an effort to crack down on sole proprietors and self-employed taxpayers who underreport their income (or inflate deductions), the Biden administration wants to require banks to report the amount of withdrawals and deposits made during the year—in addition to interest earned. For example, a Form 1099-INT, which banks send to the IRS and their customers every year, might show that a customer had $100,000 in deposits, $20,000 in withdrawals and $400 in interest. The Treasury Department says this additional information would help the IRS identify taxpayers who aren’t reporting all of their income. But the amount of information the reporting requirement would generate has already led to pushback from privacy advocates, the banking industry and Republican lawmakers. Critics say it would bury the IRS in information, much of it not useful for enforcement purposes.

Separately, the Treasury Department wants to require payment services and businesses that accept cryptocurrencies to report transactions that exceed $10,000—a requirement that already applies to cash transactions. Taxpayers who have invested in cryptocurrency need to keep good records because it’s “going to be a big focus area” for the IRS, says Tim Speiss, a partner with accounting firm EisnerAmper. The IRS is concerned that some investors are using cryptocurrency to shield income from the government, contributing to the tax gap.

The upside. While much of the focus on the administration’s proposal to shrink the tax gap has been on enforcement, there are sweeteners in the plan, too. Increasing the IRS budget would help the agency replace outdated technology and improve customer service, the Treasury says, which was abysmal during the pandemic. Taxpayers who tried to call the IRS endured long wait times, and fewer than one-fourth of them got through at all. Meanwhile, the IRS is still processing refunds for 2019 tax returns and has warned that taxpayers who filed their 2020 tax returns on paper can expect delays, too.

In part, those problems reflected the increased responsibilities of the IRS, as it was tasked with distributing billions of dollars in economic stimulus checks. But the agency has also seen its workforce decimated over the past decade by a series of budget cuts. The Biden administration wants to reverse that trend by adding customer service representatives, including staffers dedicated to helping taxpayers navigate recently expanded programs, such as the advance child tax credit.

Crackdown on Tax Preparers?

The Biden administration has renewed efforts to regulate tax preparers, something the IRS has tried unsuccessfully to do for years. Although a few states require tax preparers to register and meet minimum standards, there is no federal oversight of tax preparers. Consumer groups say that has made the business ripe for fraud. An IRS regulation that would have required tax preparers to pass a competency exam and take continuing-education courses was struck down by a federal district court in 2014. The Biden administration has called on Congress to enact legislation giving the IRS the authority to regulate tax preparers. It also wants to increase penalties for “ghost” preparers—individuals who prepare a tax return and fail to sign it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Kiplinger's Tax Map for Middle-Class Families: About Our Methodology

Kiplinger's Tax Map for Middle-Class Families: About Our Methodologystate tax The research behind our judgments.

-

Retirees, Make These Midyear Moves to Cut Next Year's Tax Bill

Retirees, Make These Midyear Moves to Cut Next Year's Tax BillTax Breaks Save money next April by making these six hot-as-July tax moves.

-

Estimated Payments or Withholding in Retirement? Here's Some Guidance

Estimated Payments or Withholding in Retirement? Here's Some GuidanceBudgeting You generally must pay taxes throughout the year on your retirement income. But it isn't always clear whether withholding or estimated tax payments is the best way to pay.

-

How to Cut Your 2021 Tax Bill

How to Cut Your 2021 Tax BillTax Breaks Our guidance could help you claim a higher refund or reduce the amount you owe.

-

Why This Tax Filing Season Could Be Ugly

Why This Tax Filing Season Could Be UglyCoronavirus and Your Money National Taxpayer Advocate Erin M. Collins warns the agency will continue to struggle with tight budgets and backlogs. Her advice: File electronically!

-

Con Artists Target People Who Owe The IRS Money

Con Artists Target People Who Owe The IRS MoneyScams In one scheme, thieves will offer to "help" you pay back taxes, only to leave you on the hook for expensive fees in addition to the taxes.

-

Cash-Rich States Lower Taxes

Cash-Rich States Lower TaxesTax Breaks The economic turnaround sparked a wave of cuts in state tax rates. But some say the efforts could backfire.

-

The Financial Effects of Losing a Spouse

The Financial Effects of Losing a SpouseFinancial Planning Even amid grief, it's important to reassess your finances. With the loss of your spouse's income, you may find yourself in a lower tax bracket or that you qualify for new deductions or credits.