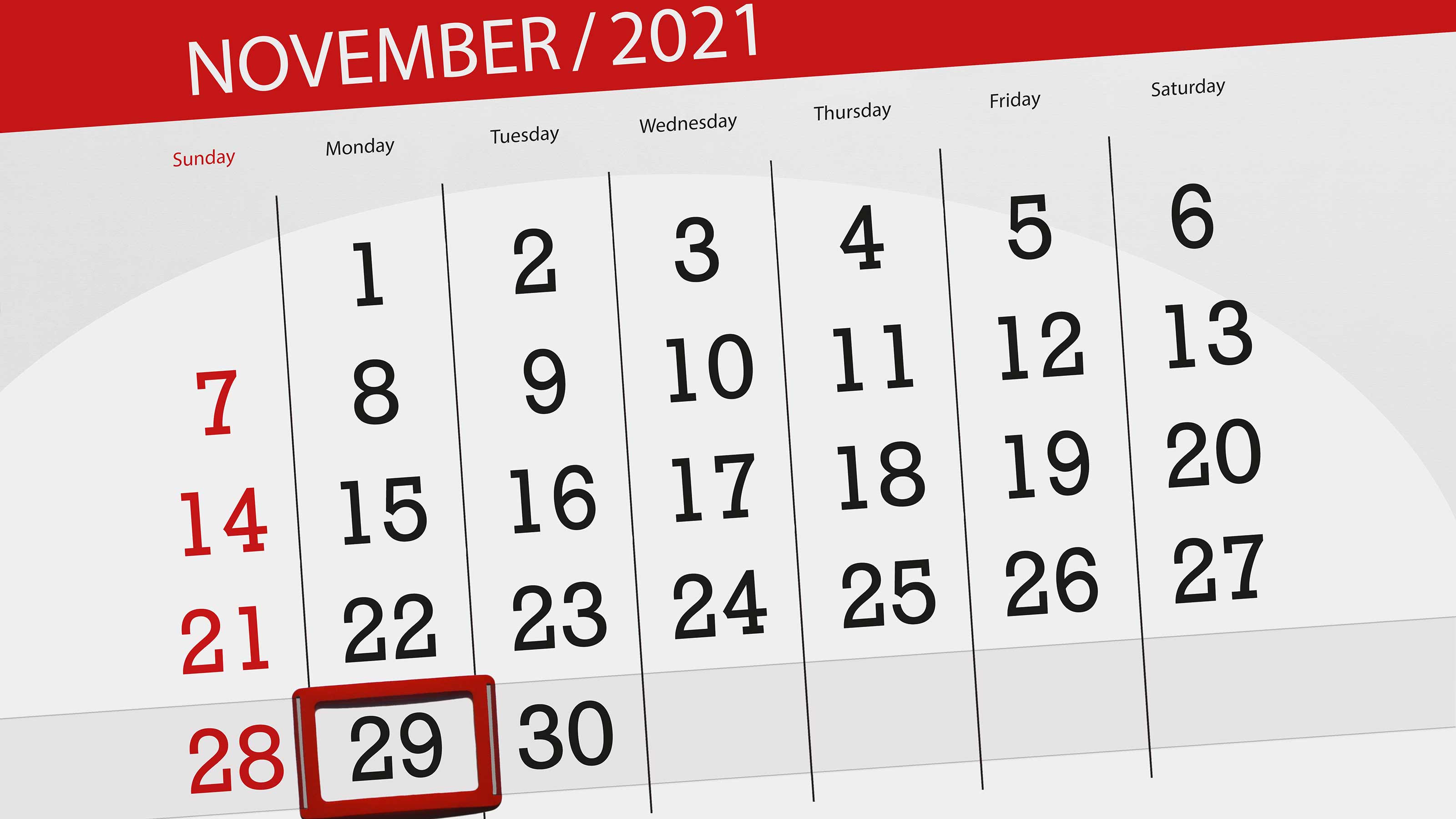

Final Child Tax Credit Payment Opt-Out Deadline is November 29

The due date for opting out of the December 15 monthly child credit payments is almost here. Missing the deadline could cost you in the long run.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The next batch of child tax credit payments is scheduled for December 15. That will be the sixth and final monthly payment this year. However, for some families, the monthly payments aren't needed and, in certain situations, might actually trigger a financial hit down the road (see below). That's why the tax law permits parents who don't want or need the money now to opt-out of the monthly child tax credit payments altogether.

If you want to opt-out, use the IRS's online Child Tax Credit Update Portal to unenroll from monthly payments. (Note: You'll need an existing IRS username or an ID.me account to access the portal.) However, there are deadlines each month if you want to opt-out before the next payment arrives. Generally, you need to unenroll by at least three days before the first Thursday of the month in which the next payment is scheduled to arrive (you have until 11:59 p.m. Eastern Time). That means you need to opt-out by November 29 if you don't want to receive the December 15 payment.

For married couples who file a joint tax return, both spouses must opt-out if you want to completely shut down your monthly child tax credit payments. If only one spouse opts out, you'll still get half of the joint payment you're scheduled to receive.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Reasons for Opt-Out of the Monthly Child Tax Credit Payments

Depending on your income, if you started receiving child tax credit payments in July, your monthly payment can be as high as $300 for each child in your family who is five years old or younger or $250 for each kid six to 17 years of age. (More money per month is sent if you begin receiving monthly payments after July.) That can add up to a lot of extra cash in your pocket. For example, if you have four kids ages 3, 7, 11 and 15, you could get up to $1,050 from the IRS each month this year if you started receiving payments in July.

So, you may be wondering why anyone wouldn't want an extra $250 or $300 per child each month. More money is something that people usually like, right? But there are various reasons why it might make sense for you to opt-out of the monthly payments if you really don't need the extra cash right now.

Under the law, the monthly payments are actually advance payments of the child tax credit you would otherwise claim on your 2021 tax return. If you continue to receive the payments, your total monthly payments will equal 50% of the total credit amount you would otherwise be entitled to claim on your 2021 tax return. You'll then claim the other half of the credit when you file your 2021 return next year. However, if you only claim half the credit on your tax return, that's going to lower your tax refund or increase the amount you owe. So, if you're the type of person who always wants a big tax refund or hates writing a check to the IRS each year, opting out of the monthly payments might be a good idea. That way, you'll be able to claim the full credit on your 2021 tax return and boost your refund/lower your tax bill as a result. (Note: We generally don't recommend trying to artificially inflate your tax refund, since that essentially amounts to giving the government an interest-free loan.)

You also might want to opt-out to avoid having to pay back all or a portion of the monthly payments you received. Generally, the amount of each payment is based on your 2020 or 2019 tax return (whichever one was filed most recently). However, the total amount of your child tax credit will be based on information found on your 2021 return. As a result, if your circumstances change in 2021, you could end up getting more than you should in monthly payments. This can happen, for example, if you earn more money in 2021 or you can no longer claim a child as a dependent this year (e.g., because of alternating custody under a divorce decree). Depending on your income, you may be required to pay back the overpayment, or at least some of it. For more on the payback requirements, see Warning: You May Have to Pay Back Your Monthly Child Tax Credit Payments.

The Future of Monthly Child Tax Credit Payments

If you opt-out of the monthly child tax credit payments now, you won't have to worry about them for the rest of the year. But what about next year? Will you have to make that decision again?

In addition to authoring monthly advance payments, Congress made other changes to the 2021 child tax credit, too. For example, the total credit amount was increased, the age for an eligible child was raised to 17, the credit was made fully refundable, and the $2,500 earnings floor was removed. A second layer of phase-outs was also added to prevent wealthier families from claiming a larger credit.

As it stands right now, these enhancements only apply to the 2021 tax year. However, President Biden and many lawmakers in Congress want to extend most of them (or even make them permanent). Congress is currently trying to pass a major spending bill (the Build Back Better Act) that includes an extension beyond 2021. But it's too early to tell if or when the bill will eventually be signed into law. There's a lot of political wrangling that will have to take place before the credit improvements are extended, but it's certainly a possibility.

We'll continue to monitor the situation and report any further child tax credit developments. In the meantime, you can read up on all the changes for this year's credit at Child Tax Credit 2021: How Much Will I Get? When Will Monthly Payments Arrive? And Other FAQs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today, Forbes, U.S. News & World Report, Reuters, Accounting Today, and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Oregon Tax Kicker in 2026: What's Your Refund?

Oregon Tax Kicker in 2026: What's Your Refund?State Tax The Oregon kicker for 2025 state income taxes is coming. Here's how to calculate your credit and the eligibility rules.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

12 Tax Strategies Every Self-Employed Worker Needs in 2026

12 Tax Strategies Every Self-Employed Worker Needs in 2026Your Business Navigating the seas of self-employment can be rough. We've got answers to common questions so you can have smoother sailing.