What You Can Do Now to Avoid Paying Higher Taxes in 2026

Tax rates are set to increase once the Tax Cuts and Jobs Act sunsets at the end of 2025, but steps you take now could put you in a better financial position.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Tax Cuts and Jobs Act of 2017 resulted in lower tax rates for Americans. The act is scheduled to expire at the end of 2025 — and when it does, tax rates will revert to 2017 levels unless Congress takes action before then.

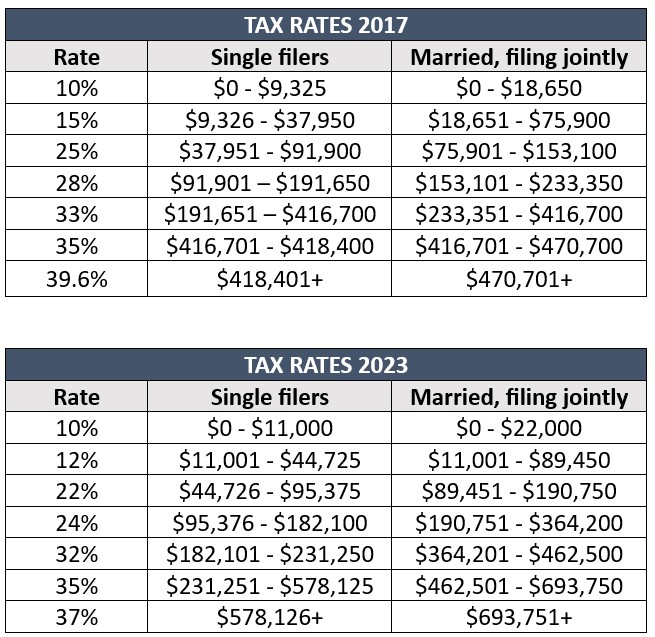

The TCJA's sunset means the majority of Americans will see an increase in how much they owe in taxes. Take a look at how income tax brackets and rates compared in 2017 and 2023:

As you can see, if you are in the 12% bracket in 2023, you would fall into the 15% bracket with the same income once the TCJA expires. If you’re currently in the 22% bracket, you will move to the 25% bracket in 2026. And if you fall in the 24% bracket in 2023, you could jump to the 28% bracket when rates increase.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

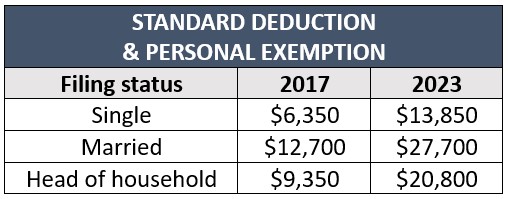

Many Americans also benefited from an increase in the standard deduction amount, which doubled following the TCJA. Here’s how standard deductions and personal exemptions changed from 2017 to 2023:

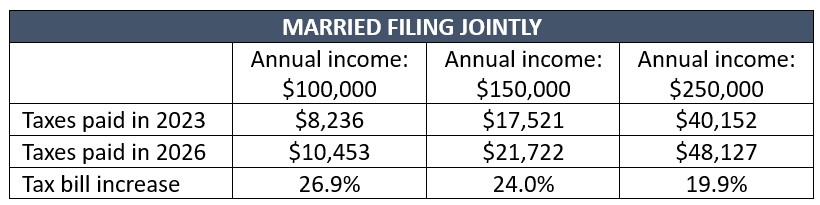

The higher tax rates and expanded tax brackets plus a lower standard deduction mean many Americans could end up paying about 20% more in taxes when the TCJA expires. Here’s a breakdown of a real-life example of how much more one couple might end up paying in 2026 vs 2023:

I like to think of our current low-tax-rate environment as a “tax sale.” Just as we would stock up on items at the grocery store during a big sale, most of us would benefit from paying taxes now, rather than waiting until rates go up. If we don’t do it now, we may be forced to pay higher rates on distributions from tax-deferred investments like 401(k)s and IRAs in retirement.

We can take advantage of lower rates by implementing proactive tax planning strategies and be what I call “tax smart.” One way to do this is through a Roth IRA conversion, where money from tax-deferred accounts is moved to a Roth IRA account. You will pay taxes on the amount converted now, but you won’t pay taxes on withdrawals made later. This strategy could result in more money to live on in retirement.

At our firm, we’ve used this strategy with many of our clients, who often ask us, “Why didn’t my previous financial planner suggest a Roth IRA conversion earlier?” My answer is that many financial planners don’t specialize in tax planning. Instead, most focus only on investment management and not the other four pillars of a complete financial plan: taxes, estate planning, health care and income. I encourage you to find a team of financial planners who specialize in all five pillars to ensure you are getting the financial plan you deserve.

Interested in more information on the TCJA expiration or other tax planning strategies? Read my book, I Hate Taxes: Lower Your Taxes, Own Your Retirement, to learn more.

The appearances in Kiplinger were obtained through a public relations program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Related Content

- Prepare for 2026 Estate Planning With SPATs, SLATs and DAPTs

- Don’t Let the 'Widow's Penalty' Blindside You: How to Prepare

- Are You Taking Too Much Risk in Retirement?

- High-Income Millennials, This Advice Is for You

- Will You Pay Higher Taxes in Retirement?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joe F. Schmitz Jr., CFP®, ChFC®, CKA®, is the founder and CEO of Peak Retirement Planning, Inc., which was named the No. 1 fastest-growing private company in Columbus, Ohio, by Inc. 5000 in 2025. His firm focuses on serving those in the 2% Club by providing the 5 Pillars of Pension Planning. Known as a thought leader in the industry, he is featured in TV news segments and has written three bestselling books: I Hate Taxes (request a free copy), Midwestern Millionaire (request a free copy) and The 2% Club (request a free copy).

Investment Advisory Services and Insurance Services are offered through Peak Retirement Planning, Inc., a Securities and Exchange Commission registered investment adviser able to conduct advisory services where it is registered, exempt or excluded from registration.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.