IRS Says Direct Deposit Is the Best Way to Receive Your Tax Refund

Direct deposit is safer, faster, and greener than getting your tax refund by mail.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Federal income tax refunds are often the largest single check that some people receive, with this tax season's year's average refund being around $3,182, according to IRS filing statistics. If you are not one of the 8 out of 10 Americans who opt to receive their tax refund through direct deposit, it is worth considering. According to the IRS, Direct deposit is the best way to receive your tax refund because it's safer, faster, and greener than getting your refund through a physical check in the mail.

With direct deposit, the IRS says your refund won't be lost or stolen. (The same electronic transfer system that processes your refund is used to transfer 98% of Social Security and Veterans Affairs funds to millions of Americans.) You will usually receive the money in less than 21 days, which is a shorter time than the month or more that you typically have to wait for when your tax refund check is sent in the mail.

Direct deposit is also cheaper. Every paper tax refund check issued by the federal government costs taxpayers more than a dollar, while each direct deposit only costs a dime. Plus, direct deposit is simple to set up. Here’s how.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How to set up direct deposit for your tax refund

Setting up direct deposit is simple whether you are filing your federal income tax return on paper or electronically, there will be an option to select direct deposit as your refund method. Or you can tell your tax preparer that you want to use direct deposit.

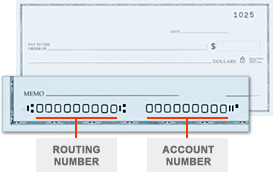

Either way, you'll need to know your bank account number and your routing number, which can be easily found through your online banking account. You can also find this information at the bottom of a check or by contacting your bank.

You can also split your direct deposit between two or three financial accounts, including your IRA. That refund deposit split can be done electronically, or if you are filing a paper return, you can use IRS Form 8888 to allocate your refund.

Remember: you should only deposit your tax refund into a United States bank and in an account in your name, or your and your spouse's name if you have a joint account.

What if I don't have a bank account?

Don’t have a bank account? You can get more information on choosing and opening a bank account by going to the FDIC website or by using the National Credit Union Administration’s Credit Union Locator Tool.

Veterans who don't have a bank account can use the Veterans Benefits Banking Program (VBBP) to access financial services at participating banks, according to the IRS. The VBBP is a partnership between VA and the Association of Military Banks of America (AMBA) designed to offer Veterans another way to receive and manage their VA benefits.

Also, if you have a prepaid debit card, the IRS says that you may be able to have your refund deposited to the card. That's because some reloadable debit cards are associated with a routing number and account number that you could provide to the IRS to deposit your tax refund.

How long will it take to receive my refund?

How long it takes to get your tax refund depends both on how you file and how you’ll receive your payment.

Those who file electronically and opt to receive payment by direct deposit can usually expect to receive their refund within 21 days. If you choose to file by paper, you’ll likely have to wait at least four weeks before funds hit your account, and even longer if you plan to receive a check in the mail.

Although the vast majority of tax refunds are received in less than three weeks, delays can occur. For example, if there are any errors on your taxes, you will have to wait longer to receive your refund while these errors are amended. Also, last tax season, many Americans waited longer than usual for their tax refunds due to the IRS backlog of 10.2 million unprocessed returns, mostly paper-filed. That's partly why many people file their federal tax returns electronically.

Can I track my tax refund?

To track your refund, the IRS offers an online "Where's My Refund?" feature. You can track your tax refund regardless of whether you filed your tax return by mail or electronically. Alternatively, you can call 800-829-1954 to get information on the status of your refund.

If you file electronically, you will only have to wait 24 hours before you can track the status of your refund. But if you filed your federal income tax return by mail, it can take six months or more.

Related content

- Tax Season 2024: Seven IRS Changes to Know Before You File

- How to Track Your Federal Tax Refund Status

- How Much Richer Could You Be Without A Big Tax Refund?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Erin pairs personal experience with research and is passionate about sharing personal finance advice with others. Previously, she was a freelancer focusing on the credit card side of finance, but has branched out since then to cover other aspects of personal finance. Erin is well-versed in traditional media with reporting, interviewing and research, as well as using graphic design and video and audio storytelling to share with her readers.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Oregon Tax Kicker in 2026: What's Your Refund?

Oregon Tax Kicker in 2026: What's Your Refund?State Tax The Oregon kicker for 2025 state income taxes is coming. Here's how to calculate your credit and the eligibility rules.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

12 Tax Strategies Every Self-Employed Worker Needs in 2026

12 Tax Strategies Every Self-Employed Worker Needs in 2026Your Business Navigating the seas of self-employment can be rough. We've got answers to common questions so you can have smoother sailing.