Trump's Tariffs on Canada and Mexico to Spike Food, Gas Prices

The neighboring countries are major exporters of fresh food, auto, gas, and industrial supplies to the U.S.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

President Donald Trump is using tariffs as a bargaining chip with the United States' top trading partners. It’s likely to hurt your wallet.

After initially planning to levy 25% tariffs on Mexico and Canada last month, the Trump administration pulled that plan back after reaching a deal with the leaders of the neighboring countries in early February. However, that 30-day pause is over and Trump's latest proposal, levying the tariffs on March 4, has gone into effect.

Mexico and Canada are two of the United States’ top trading partners. Aside from the European Union, which is comprised of 27 sovereign nations, Mexico is the largest source of all U.S. imports.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Economists warn that tariffs on China, Mexico, and Canada can impact the cost of everyday essentials like food, gas, and clothing. It'll also put upward pressure on inflation.

Here’s where you could see prices rise sooner than you think if Trump imposes the tariffs, beginning with a quick recap of where things stand with the trade war.

Key Points

- Trump reached a deal in early February with Mexico’s President Claudia Sheinbaum Pardo and Canada's outgoing Prime Minister Justin Trudeau, agreeing to a 30-day delay on tariffs as long as they reinforce border security.

- The Trump administration had planned steep tariffs in retaliation for allowing illicit drugs and migrants to cross the border, the White House said.

- The U.S. also hit China with a unilateral 10% tariff on all imported goods on Feb. 1, 2025. China retaliated with 10% and 15% tariffs on targeted U.S. imports and a lawsuit. China's duties were planned for as soon as Feb. 10.

- Trump floated a March 4 date to impose the 25% tariffs and has just followed through with that threat.

- Canada's response was immediate, with outgoing Prime Minister Justin Trudeau imposing a 25% tariff on $20 billion of U.S. goods and planning more tariffs.

- China, facing its own tariff increase, also reportedly plans to impose duties on U.S. agricultural products. Mexico is expected to announce its response soon.

Food prices could spike across the board

Meanwhile, prices in the grocery aisle can already leave you with a bad taste, and a potential full-blown trade war will likely worsen it. The cost of food is currently 25% higher than pre-COVID levels, the Food Industry Association said, and it doesn’t seem to be easing anytime this year.

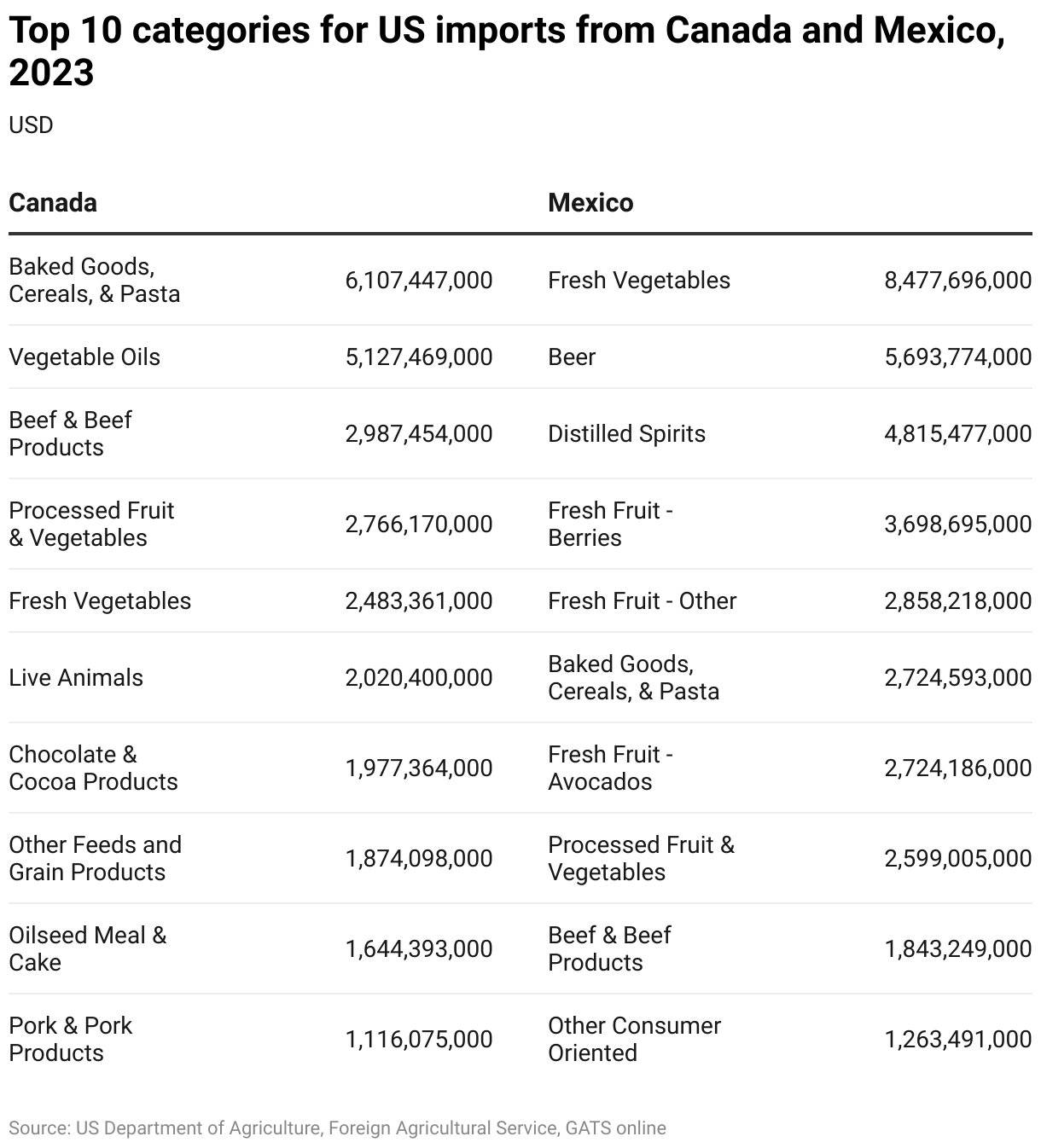

Mexico and Canada are two of the United States’ top trading partners. Mexico is the largest supplier of fresh fruit and vegetables to the U.S., responsible for 92% of all agricultural imports, according to the latest government data. It’s also a major supplier of distilled spirits, per the International Food Policy Research Institute.

A 25% tariff on Mexico will cause the cost of fresh vegetables, fresh fruit and berries, baked cereals, and avocados to rise.

Outgoing Canadian Prime Minister Justin Trudeau previously said U.S. consumers will pay more if Trump imposes tariffs on Canadian goods. For Trudeau, nothing was going to be “off the table” as the country considers retaliatory tariffs on beverages like Florida orange juice and other goods due to Trump's 25% tariffs on all Canadian imports. The list may go on.

According to the U.S. Department of Agriculture, Canada is a major supplier of essentials on your grocery list. Just to name a few: baked goods, cereals, pasta, vegetable oils, beef products, live animals, chocolate, and other grain products are imported from Canada.

The price of vehicles could rise significantly

Purchasing a car or auto parts will become even more expensive if tariffs are levied on Canada and Mexico.

The steep tariffs would interrupt supply chains from the auto industry causing the spike in prices, Wells Fargo analysts warned. Canada and Mexico are considered top exporters of automotive parts and vehicles to the U.S.

Prices for U.S.-made automobiles could rise as much as $2,100 once tariffs are imposed, Fortune first reported. Additionally, vehicles manufactured completely in Canada and Mexico may cost as much as $8,000 to $10,000 more.

Hardest hit companies include some of the biggest U.S carmakers — General Motors (GM), Ford, and Stellantis. All three have manufacturing plants in Mexico and Canada and could stand to lose between $5 to $9 billion.

Some GM vehicles manufactured in Mexico include the Chevrolet Blazer, Chevy Equinox, and Cadillac Optiq, all made in the Ramos Arizpe plant. There’s also the Chevy Equinox EV.

As Kiplinger reported, electric vehicles may also be hit by a separate Trump policy that aims to eliminate up to $7,500 federal tax credit for EV purchases.

Gas prices to rise in the U.S.

Prices as the gas pump would rise more than expected under Trump's 25% tariffs on Canadian imports.

Canada is a main source of crude oil imports and industrial supplies like steel for the United States. More than 71% of U.S. crude oil imports were supplied by Canada and Mexico in 2023, according to a new report from the Congressional Budget Office (CBO). Of that share, 60% of oil came from Canada.

The steep 25% tariffs could impact consumer prices for gasoline, diesel fuel, and other petroleum products across the country. Some states will be more affected than others by tariffs, mainly the Midwest.

That’s bad news, given that gas prices are already on the rise due to seasonal patterns, and are slated to reach $3.50 per gallon by spring.

The premier of Ontario, Doug Ford has been more forthcoming about the implications of Trump’s tariffs, noting that Canada won’t remain complacent.

“We will cut off energy down to Michigan, over to New York State, and over to Wisconsin,” Ford said in a report by the Associated Press. “I don’t want this to happen.”

Tariffs would lead to higher inflation

If you were expecting inflation to go down, tariffs won’t be the solution.

A new Wells Fargo report found that imposing 25% tariffs on all imports from Mexico and Canada on February 1, would lead to retaliation and result in slower domestic growth for the U.S. and higher consumer prices.

Model simulations show that the annual rate of consumer price inflation would be half a percentage point higher by the year-end if Trump’s tariffs were enacted. By comparison, GDP growth would fall by a full percentage point relative to the expected baseline this year.

Trump tariffs Bottom line

Tariffs are an overarching theme during the Trump administration’s second term, and economists warn it may have collateral damage on your wallet.

As reported by Kiplinger, prices of everyday goods will spike if steep tariffs are enacted. The U.S. imported nearly $500 billion worth of merchandise from Mexico, and $410 billion from Canada in the twelve months leading up to November 2024.

While Canada and Mexico account for just under 30% of all U.S. goods imports, its categories are crucial for the United States. Auto parts and manufactured vehicles, crude oil, and fresh foods and vegetables are some areas that may be hard hit by Trump's 25% tariffs.

Economists say Trump’s tariffs will ignite a trade war, which will increase U.S. consumer prices and impact Canada and Mexico’s economies. So far, Canada and Mexico's leaders have responded with retaliatory measures.

As reported, tariffs levied on foreign nations are paid by U.S. importers. That means a 25% tariff on Canadian goods will be paid by the U.S.-based importer, and that cost is generally passed to consumers like you so businesses can make a profit.

The U.S. Mexico-Canada Agreement (USMCA) is set to be reviewed next year; these tariff discussions may speed up that timeline.

Stay informed, as these looming changes can impact your wallet.

Related Content:

- Tariffs Could Make Your Shopping Pricier in 2025

- Tariffs: What They Are and How They Impact Your Wallet

- Is Trump Taking the EV Tax Credit Away? What You Need to Know

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Avoid a Tax Surprise After Your 2026 Super Bowl Bets: A New IRS Rule to Know

Avoid a Tax Surprise After Your 2026 Super Bowl Bets: A New IRS Rule to KnowTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

Tax Season 2026 Is Here: 8 Big Changes to Know Before You File

Tax Season 2026 Is Here: 8 Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.