Kiplinger’s Best Values in Tax Software, 2021

We ranked the most popular tax-prep packages to help you find the ones that provide the best experience at the lowest cost.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If the COVID-19 pandemic forced you to move or work remotely, file for unemployment benefits or pick up a side gig to earn extra income, filing your tax return could be more complicated than in the past. The economic stimulus checks sent to millions of taxpayers, which represented advance payments of a 2020 tax credit, also create the potential for confusion.

Preparing your own return instead of hiring a preparer could save you money, but tax software can get expensive in a hurry, even for taxpayers with fairly straightforward returns. And a program that shortchanges your refund—or gets you in trouble with the IRS—is no bargain.

To help you find the program that’s right for you, Kiplinger reviewed the online versions of the most popular programs and ranked them based on cost, ease of use, tax help and more. We used two fictional tax returns: one for a single taxpayer who had income reported on Form W-2 and some freelance income, and a second for a married couple with a young child and a mortgage who itemized deductions. To account for some pandemic-related circumstances that could affect taxpayers, we looked at how the programs handled the economic stimulus payments millions of taxpayers received in 2020 and early 2021, which represented an advance payment of a tax credit on your 2020 tax return. In addition, we gave one of the spouses in our fictional couple unemployment benefits, and we had our single taxpayer move from Maryland to his parents’ home in Ohio to determine how the programs accounted for multiple state filings. (For more on your tax obligations if you moved last year, see There's Still Time to Save on 2020 Taxes.)

Prices quoted here are as of January 14. Many tax-software providers engage in surge pricing, which means the cost could rise as the tax-filing deadline approaches.

When to hire a pro

Although tax software is designed to handle a multitude of situations, sometimes the wiser course is to outsource the job to a tax professional. When to consider getting help:

You’re self-employed or own a business. Taxpayers who work for themselves are eligible for a long list of deductions that do-it-yourselfers might overlook. They’re also subject to more scrutiny by the IRS.

You own rental property. The rules governing tax treatment of rental property are complex, and this is another area that tends to attract IRS attention — particularly if you report large rental losses.

You need to file more than one state tax return. A tax preparer can help you comply with tax rules if you lived in more than one jurisdiction last year.

Check the credentials of anyone you hire. Certified public accountants are licensed by state boards of accountancy, studied accounting at a college or university, and have passed a rigorous exam. You can get a list of local certified public accountants from your state’s CPA society.

Enrolled agents must pass a rigorous test and meet annual continuing-education requirements, and are licensed to appear before the IRS. To locate an enrolled agent in your area, go to naea.org.

Who can file for free?

Even a taxpayer with modest income could end up spending more than $100 on tax software, particularly if he or she had freelance income, lived in more than one state or did something as mundane as contributing to a health savings account. So before you sign up for a program, see whether you’re eligible to prepare and file your federal tax return — and possibly your state tax return, too—for free.

If you had adjusted gross income of $72,000 or less in 2020, you can prepare and e-file your federal tax return through IRS Free File, even if your return is complex. Some tax-preparation companies that participate in IRS Free File include a free state tax return; others will charge you for that. This year, there are nine Free File participants. Each participant is permitted to impose its own criteria. The IRS provides a tool that will help you find a program you’re eligible to use.

Be careful: Some tax software providers use search terms such as “free file” to persuade customers to sign up for programs that end up costing them money. To avoid confusion, go straight to the source: IRS Free File.

If you don’t qualify for IRS Free File but have a fairly straightforward return, consider Free File Fillable Forms. This program allows you to fill out your tax return electronically and either e-file it or print it and mail it in. The program will do the math but doesn’t offer guidance or advice, and it doesn’t include a state tax return.

Our methodology

We ranked the programs on cost, navigation (ease of use), the availability of tax help and the number of state returns included in the base price. We deducted points if more-expensive upgrades were needed. For each tax program on our list, we applied our criteria to two fictional tax returns. One of our returns was for a single taxpayer who rents an apartment, received one W-2 form, earned $5,000 in freelance income, has a student loan and has no dependents. In addition, he moved from Maryland to his parents’ home in Ohio. The other return was for a married couple who own a home, have a young child, received investment income, donated to charity and contributed to a health savings account. They both received a W-2 form for earned income and one spouse collected unemployment benefits. They both contributed to IRAs and 401(k) plans.

#1 - FreeTax USA

- Pros: Free federal return for even complex tax situations

- Cons: Program can’t import W-2s and 1099s

- Website: freetaxusa.com

FreeTax USA still earns top marks this year for making the tax-filing process as smooth as possible. Unlike the other programs, such as those offered by H&R Block and TurboTax, you don’t need to upgrade to a more expensive version to report health savings account contributions, gig income or investment income. Both of our fictional taxpayers were able to file a federal tax return for free.

However, FreeTax’s treatment of stimulus payments could confuse some users. The program refers to the taxpayer’s “economic impact payment” with “stimulus” in parentheses. If you’re a nervous taxpayer, that could be alarming. (Other programs we reviewed were more straightforward in their stimulus nomenclature.)

If you have questions about your stimulus payment (or anything else), live help is available for just $7. FreeTax is also a good option for taxpayers who need to file multiple state tax returns, which cost just $13 each. If our single taxpayer required live tax help along the way, his grand total would be $33 to file a federal tax return and two state returns.

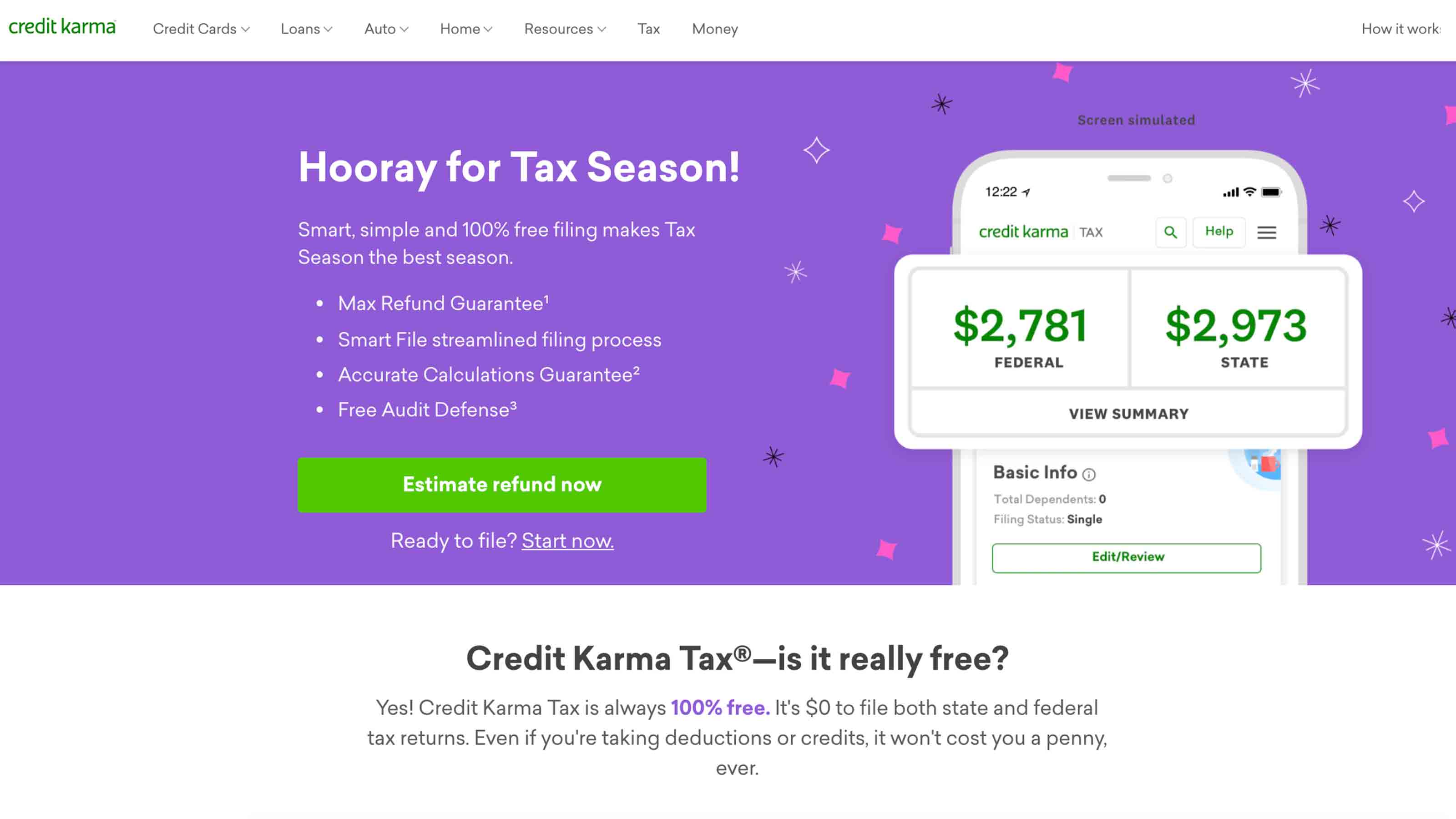

#2 - Credit Karma Tax

- Pros: Free federal return and one free state return for all tax situations

- Cons: Doesn’t support multiple state returns

- Website: creditkarma.com/tax

Credit Karma is the clear winner when it comes to cost. The tax software is still free and supports nearly all of the forms the average taxpayer needs.

But things have changed since last year, when this program received our top ranking. In late November, Credit Karma Tax was purchased by Square, a financial technology company that developed Cash App, a mobile payment service. With a new overlord comes potential privacy concerns, as you’ll be asked early on if you want to sync your tax and Cash App data. Note that you can opt out of this information-sharing request.

Even though the website states that you can import previous year’s tax returns from competitors such as H&R Block and TurboTax, no import button appeared during our test-drive. As was the case in the past, the program can’t handle multiple state returns, which makes it unpalatable for people who need to file in more than one state. Our fictional single taxpayer would need to buy a different program to file just one more state tax return. The program was more useful for our couple, who needed to file only one state return. For example, it went the extra mile to make sure all identification numbers were valid when reporting unemployment benefits. If cost is your biggest concern and you didn’t move last year, this program will deliver.

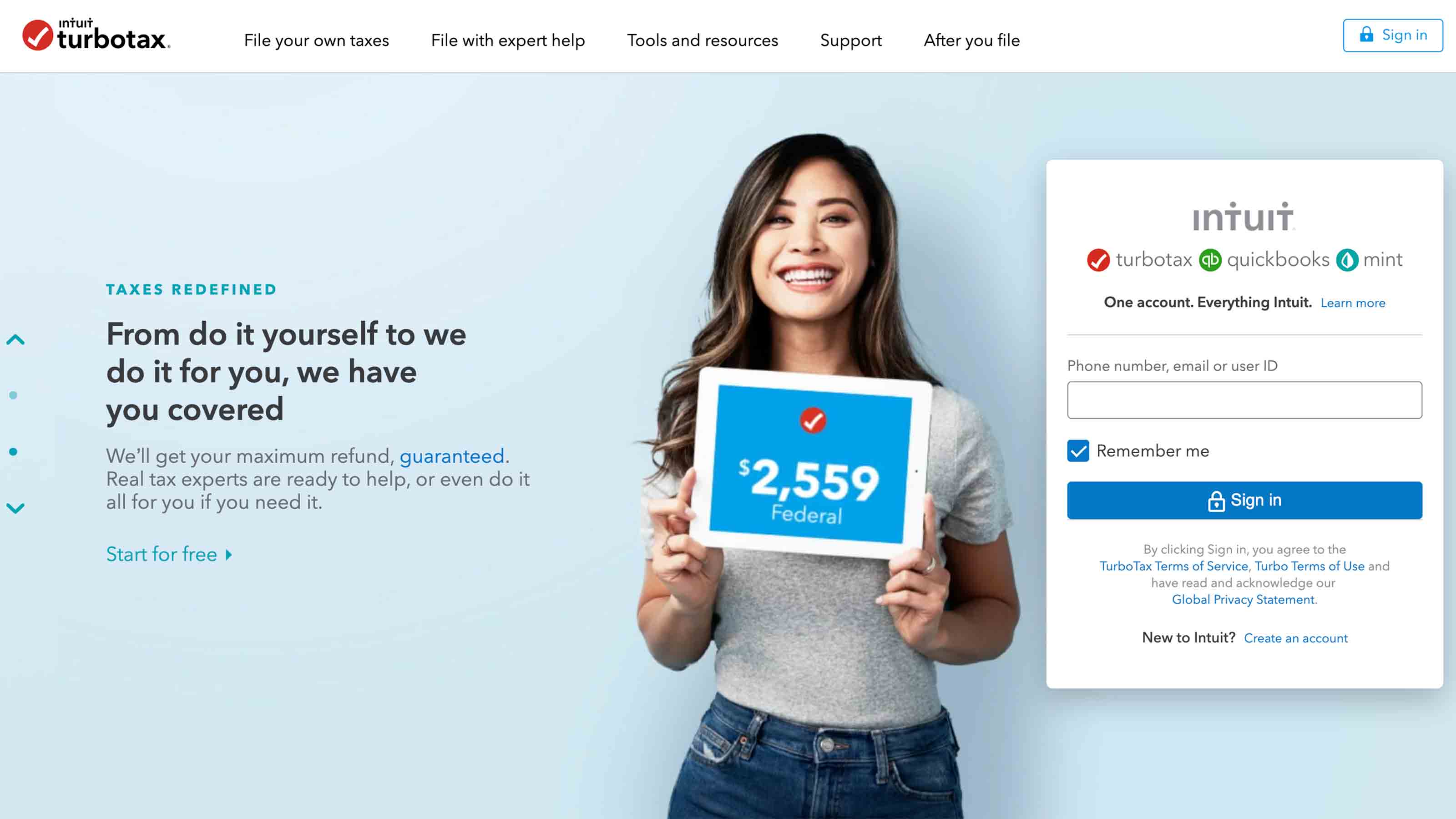

#3 - TurboTax

- Pros: Superior navigation, plenty of support, imports W-2s and 1099s

- Cons: Costly, even for straightforward returns

- Website: turbotax.com

TurboTax is the Mercedes of tax software, promising a smooth ride with plenty of bells and whistles and handholding along the way. Answers to your questions are readily available via the TurboTax community, how-to videos and other resources.

The program is a breeze to navigate, even if you need to go back to add information or fix errors. But you’ll pay a premium for this luxury vehicle. TurboTax’s free product is limited to taxpayers who claim the standard deduction, have only W-2 income and don’t deduct student loan interest (even though this deduction is available to nonitemizers). And it doesn’t take much to require an upgrade to the paid versions. Because our fictional single taxpayer had $5,000 in freelance income, he was required to use TurboTax Self-Employed, which costs $90. His two state tax returns cost $80, for a total of $170. On the plus side, TurboTax did a nice job of breaking down his state tax obligations based on where he lived last year. The married couple had to upgrade to TurboTax Premier ($70) because they had $5,000 in investment income.

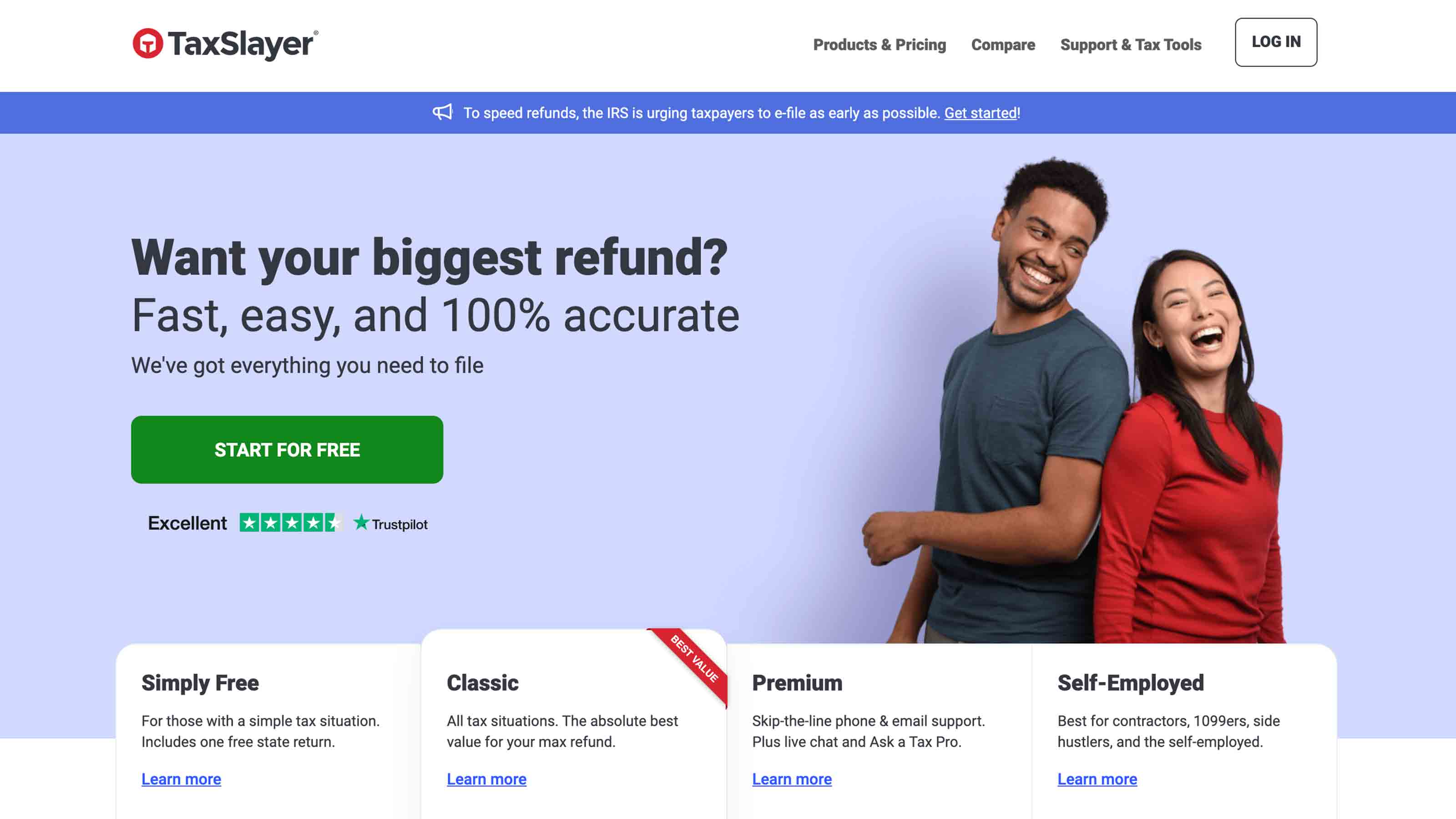

#4 - TaxSlayer

- Pros: Low cost; imports W-2s and previous-year return

- Cons: Marginal guidance; fee for professional help

- Website: taxslayer.com

If you know your way around the tax laws, TaxSlayer Classic is a bargain. For only $17, you get access to all the forms you need. There are no forced upgrades if you have income from a side job, pay student loan interest, contribute to a health savings account or have any other tax situation that’s beyond the basics. You’ll have to pay an extra $32 for each state return, but even so, for our hypothetical single taxpayer who lived in two states last year, the total bill for one federal and two state returns is $81. That’s not bad when compared with the competition.

If you get stuck on a tax question, there’s some basic guidance available. Free e-mail and phone support is offered, too. But if this is your first time preparing a tax return on your own, you might want to upgrade to TaxSlayer Premium for an extra $20. Not only will that bump you to the front of the line for e-mail and phone support, but it will also get you live chat and help from a tax professional. Because the written advice is only so-so and navigation can be tricky, you’ll recoup that $20 and more if a tax pro helps you avoid a costly mistake on your return.

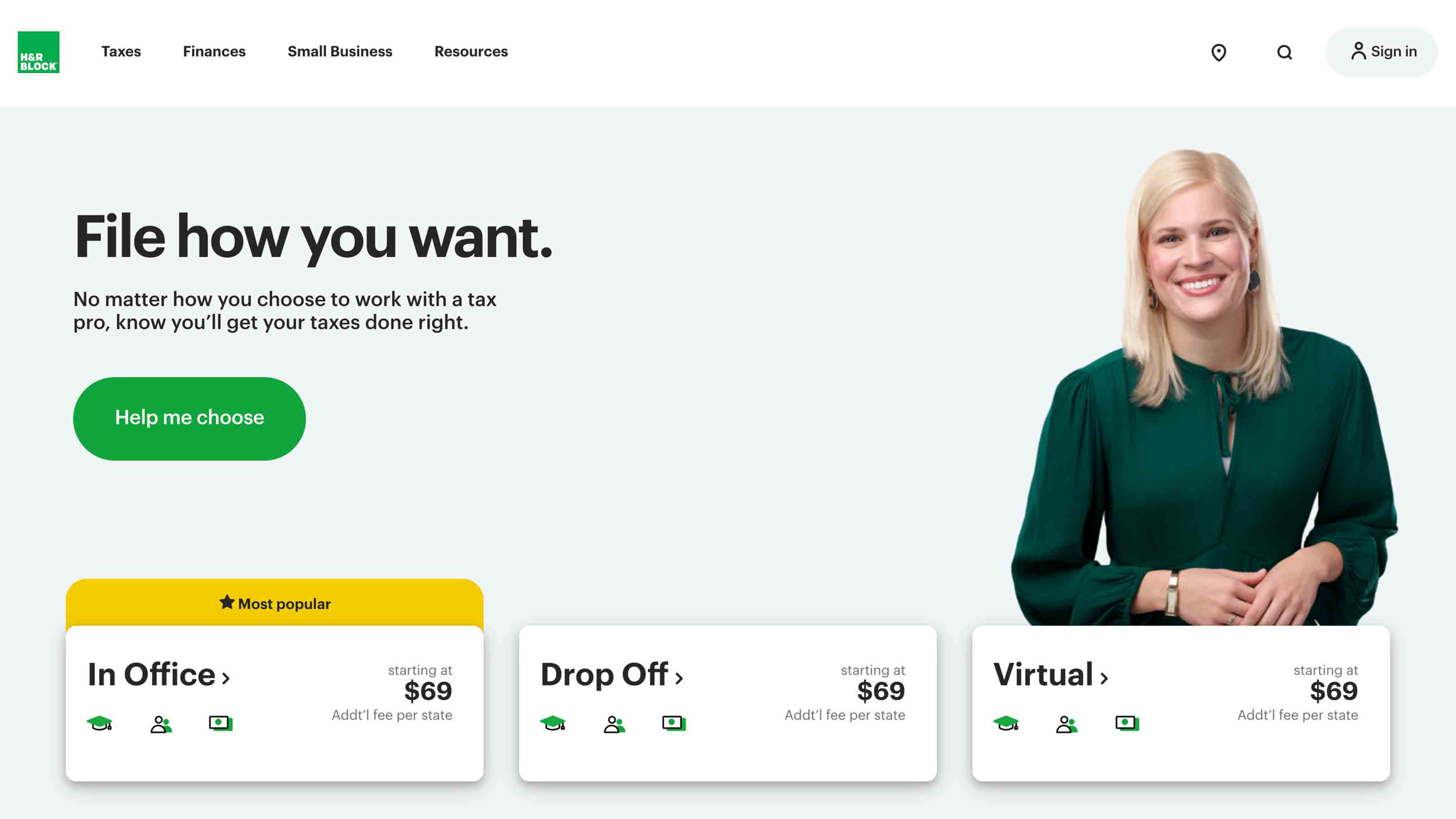

#5 - H&R Block

- Pros: Deluxe offering now available for gig workers

- Cons: High price

- Website: hrblock.com

If consistency is what you’re looking for, H&R Block does not disappoint. Last year, the company offered eight options with prices tied to the forms you needed to use and availability of live tax help. This year, the company has scaled back to four programs, and each has the option to add live help before you start or as you’re working through the program.

The Deluxe offering, which costs $30, did a good job of recognizing tax issues that arose because of the pandemic. The program explains how to report unemployment benefits and claim any stimulus money you haven’t already received. Gig workers who don’t have any deductible expenses to report don’t have to upgrade to H&R Block Self-Employed. However, our single taxpayer had to use the Self-Employed version because he had deductible business expenses. His cost: $84.99, plus $36.99 for each state return; because our hypothetical taxpayer moved to another state, his total cost was about $159.

On the plus side, retirees, students and workers with just W-2 income should be able to file a federal return and up to three state returns for free by using Block Free Online. (They may also be eligible for IRS Free File.)

#6 - TaxAct

- Pros: Frequent tax tips; imports W-2s and previous-year return

- Cons: Limited support

- Website: taxact.com

TaxAct has improved its navigation since our last tax software review, with easily digestible tax advice sprinkled throughout the program. But you won’t get much help with your questions (unless you’re willing to pay for it), so users need to be comfortable with the tax code to use this program effectively.

On the plus side, TaxAct lowered prices for its federal tax returns from a year ago. Its Deluxe version, available to itemizers who don’t have investment income, is $24.95, down from $30 in 2020. But because our fictional single taxpayer had freelance income, he had to upgrade to TaxAct Self-Employed, which costs $64.95 for a federal tax return plus $44.95 for each state tax return. That works out to nearly $155 for a federal return and two state returns. Because the married couple had some investment income, they were required to use TaxAct Premier, which costs $34.95, plus $44.95 for a state tax return, for a total of about $80.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Block joined Kiplinger in June 2012 from USA Today, where she was a reporter and personal finance columnist for more than 15 years. Prior to that, she worked for the Akron Beacon-Journal and Dow Jones Newswires. In 1993, she was a Knight-Bagehot fellow in economics and business journalism at the Columbia University Graduate School of Journalism. She has a BA in communications from Bethany College in Bethany, W.Va.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for You

A Free Tax Filing Option Has Disappeared for 2026: Here's What That Means for YouTax Filing Tax season officially opens on January 26. But you'll have one less way to submit your tax return for free. Here's what you need to know.

-

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?

2026 State Tax Changes to Know Now: Is Your Tax Rate Lower?Tax Changes As a new year begins, taxpayers across the country are navigating a new round of state tax changes.