Trump’s Plan to Eliminate Taxes on Social Security Forgets Your Children

A new analysis reveals that the policy change would mainly benefit high-earning retirees or those close to retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

President Donald Trump vowed to eliminate income taxes on Social Security benefits, a policy shift that experts warn would spell disaster for the welfare savings of the nation’s youngest, including those not yet born.

Slashing the income tax on Social Security would reduce revenues by $1.5 trillion over a decade and increase the federal debt by 7% by 2054, according to a study produced by the Penn Wharton Budget Model, a nonpartisan, research-based initiative at the University of Pennsylvania.

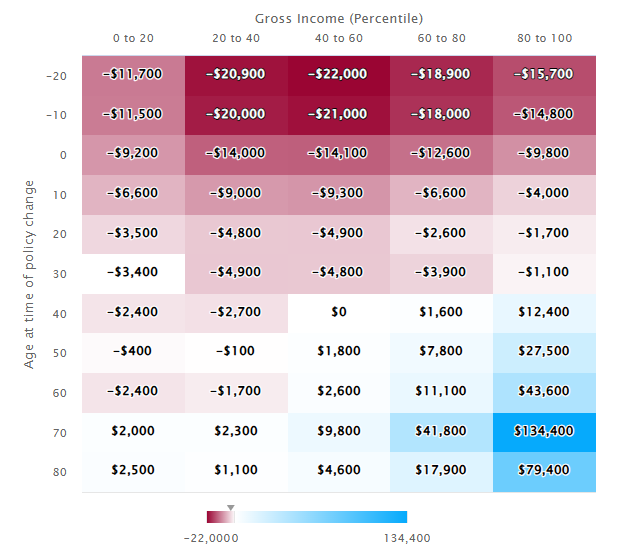

While nearly all retirees may see welfare gains, only the highest earners would gain more than $100,000 in remaining lifetime welfare. Yet, individuals under the age of 30, and those who have not yet been born, may face the largest losses — up to $22,000 over their lifetime.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That’s because eliminating taxes on Social Security benefits reduces incentives to save and work while increasing the federal debt, the analysis found. Average wages and GDP are also projected to fall over time.

Here’s what could happen if the Trump administration were to end taxes on Social Security today.

Related: Check out Kiplinger's tax blog for the 2025 filing season. We're providing live updates, news, information, and commentary to help you navigate your taxes.

How Social Security is taxed

Before diving in, as you know, Social Security benefits are taxable based on your income, regardless of your age.

- Beneficiaries with a combined income below $25,000 ($32,000 for joint filers) pay no taxes on their benefits.

- Those with combined income between $25,000 and $34,000 ($32,000 and $44,000 for joint filers) are taxed up to 50% of their benefits.

- Those with combined income above $34,000 ($44,000 for joint filers) are taxed up to 85% of their benefits.

How exactly does that work?

About 85 cents of every Social Security tax dollar you pay goes toward a trust fund. Your tax dollars are used to pay monthly benefits to current retirees, their families, surviving spouses, and children of workers who have died.

According to the Social Security Administration (SSA), about 15 cents goes to a trust fund that pays benefits for people with disabilities and their families. Less than one penny out of every tax dollar is used by the SSA to manage the programs.

In short: the taxes you currently pay on Social Security aren’t held in a personal account for you to use when you get your benefits. As of January 2025, there are 68 million Social Security beneficiaries.

What are the Social Security trust funds?

Any tax dollars you pay that don’t go towards paying current beneficiaries are placed into the Social Security trust funds. These are managed by the U.S. Treasury Department and are tapped into to pay Social Security benefits, disability benefits, and administrative costs.

However, as it stands, that retirement trust fund is set to become insolvent by 2033. As reported by Kiplinger, Trump’s proposal to end taxes on Social Security benefits would speed up the program’s depletion by one year.

Once that happens, beneficiaries are expected to receive only 83% of their full benefits.

But the chance of Congress letting that happen is slim.

Ending taxes on Social Security benefits high-earners

If Trump were to eliminate taxes on Social Security benefits today, the biggest win would be for current retirees and the highest earners who are close to retirement.

- A 60-year-old in the highest three quintiles of gross income would see a welfare gain equal to a one-time payment ranging from $2,600 to $43,000 in their lifetime.

- By contrast, someone the same age who’s in the bottom 20th income bracket would see their welfare decrease by $2,400.

- At the same time, 50-year-old households in the top three income quintiles gain between $1,800 and $27,500.

Only the highest earning and eldest Millennials would benefit from ending taxes on Social Security benefits. Those in their 40s who belong to the top income brackets would see a welfare gain equal to a one-time payment of up to $12,400.

Meanwhile, anyone in their 40s within the 40th to 60th gross income bracket would see no gain at all.

Below that, any younger generation — no matter their income — would see a negative impact on their welfare.

Young adults and future generations are worse off

While more than 60% of current living households and over 95% of retirees would benefit from eliminating taxes on Social Security benefits, all future generations would be worse off.

- Those born today experience a welfare loss between $9,200 and $14,000.

- Unborn households face the largest losses, ranging from $11,700 to $22,000. This includes those born up to 20 years into the future.

As mentioned, the policy change reduces incentives to save for retirement and would lead to an increase in federal debt. According to the Penn Wharton study, this model does not encourage a higher labor supply which would result in declines in capital and wages over time.

The result is significant welfare losses, particularly for the youngest and unborn generations.

Retirees benefit, some more than others

As mentioned, while all retirees benefit from ending taxes on Social Security benefits the results would not be equal.

Higher-income retirees, who currently pay the most taxes on Social Security, gain between $11,000 and nearly $135,000. Meanwhile, households in the two lowest quintiles would see positive gains averaging between $1,000 and $2,000.

Social Security taxes: What’s next?

President Trump has reaffirmed his pledge to end taxes on Social Security benefits but has yet to offer concrete plans on how it would work. Any changes to Social Security would require an act of Congress with bipartisan support.

Being aware of how Social Security policy changes can impact your wallet, and that of future generations is more important than ever as you plan for retirement.

As mentioned, experts warn that cutting the tax on these benefits can cause millions of families to slip under the poverty line. While most retirees would see significant gains in welfare benefits, it wouldn’t be evenly distributed. Only the highest earners would see a notable difference.

If you have questions about calculating taxes on your Social Security benefits, you can consult a trusted tax professional or financial planner.

Related Content:

- How the IRS Taxes Retirement Income

- Taxes on Social Security Benefits: Five Things You Need to Know

- What’s Wrong With Trump’s Pledge to End Taxes on Social Security Benefits

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

Do You Pay Property Taxes in Tennessee? What You Need to Know in 2026

Do You Pay Property Taxes in Tennessee? What You Need to Know in 2026Property Taxes State lawmakers are moving to ban state property taxes, but can they stop the local rate spike? Here's how 2026 could lower your Tennessee property tax bill.